Giving Back So Others Can Start Moving Forward

Year In Review –– 2023

Giving Back So Others Can Start Moving Forward

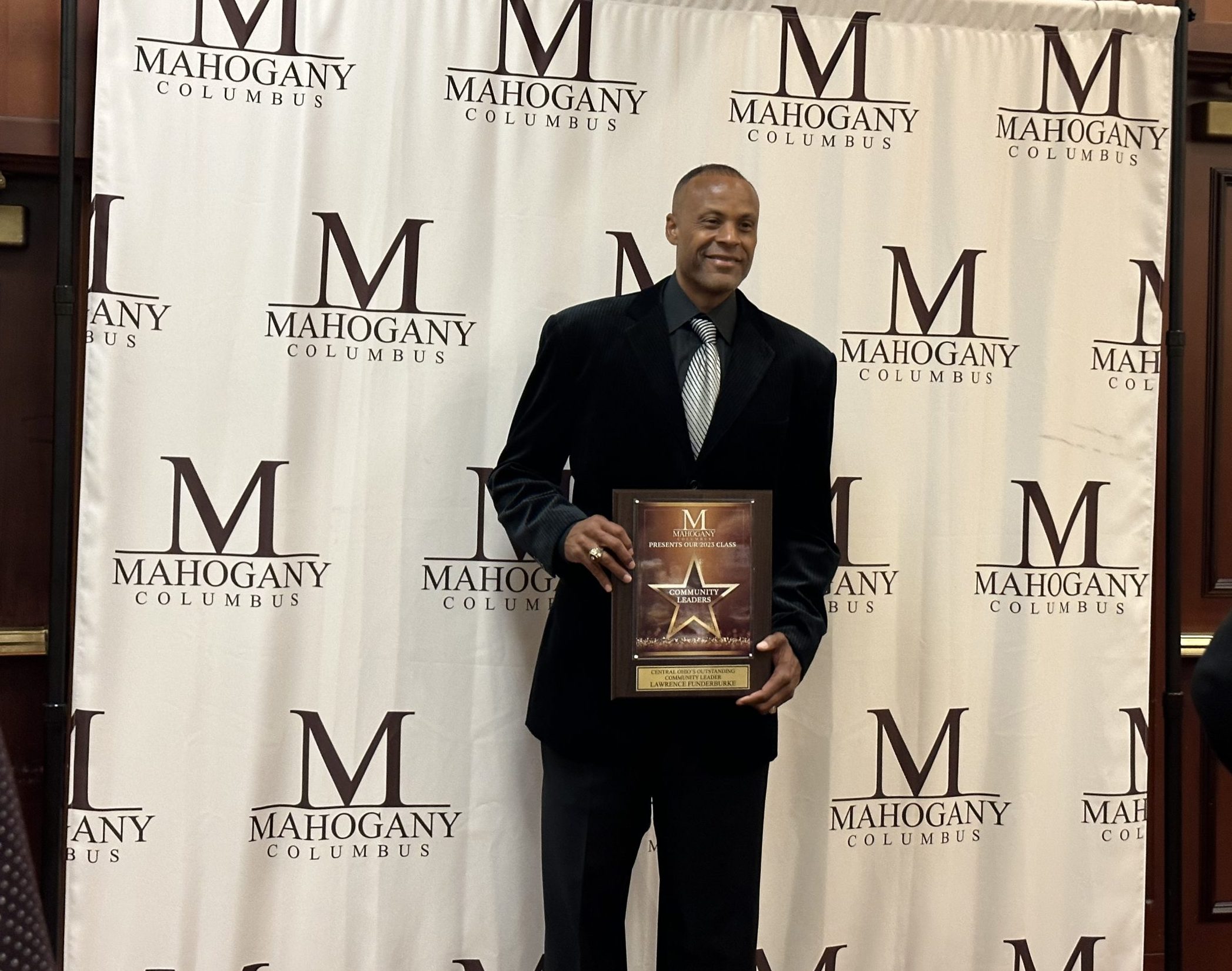

Monya and I want to thank LFYO supporters, partners, and board members who made 2023 a year to remember. More than 750 at-risk individuals were impacted by our programs, workshops, and camps. From personal branding to job skills readiness to financial fitness, participants were given the game plan to achieve better life prospects and legacy pathways through cutting-edge offerings. Every innovative app and sensory-based tool is created in-house to make learning an inviting and empowering experience. For our efforts, LFYO was the recipient of Mahogany Columbus’ Central Ohio’s Outstanding Community Leader Award.

The Columbus Foundation

Central Ohio’s Outstanding Community Leader Award

Crimson Cup Coffee Headquarters

2023 LFYO Fundraising Luncheon

The 2023 LFYO Fundraising Luncheon on September 15th at Hyde Park Prime Steakhouse was spectacular. The beautiful weather. The first-class service. The heartwarming atmosphere. Attendees were treated to scrumptious appetizers, a steak-chicken-and-salmon trio, and a delectable dessert combo. Speakers shared insights that resonated on a number of fronts, most notably how to make a lasting difference in helping vulnerable males reach outlier status as statistical anomalies. As Clark Kellogg and Gene Smith highlighted in their riveting speeches, Buckeye Nation is a family of caring souls and equally generous hearts.

All-Star Sponsor Lindsey and Jacob Osborn (far right)

All-Star Sponsor Linda and Roger Blackwell (center right)

All-Star Sponsor Rebecca and Brandon McAllister (center right)

Legacy Sponsor Tom Fleming with Guests (front row center)

First Church of God

In partnership with The GoodLife Foundation and Park National Bank, we hosted a homeownership and economic empowerment workshop for underserved communities on November 9th.

Holiday Generosity

The holidays offer us a time to (re)connect with family and close friends. They also provide us with the privilege of helping those most in need. We want to recognize the Fahlgren family for blessing Cinnamon, a single mother of five, with groceries and Christmas presents. Tears swelled in Cinnamon’s eyes as she watched her youngest child, an adorable three-year-old, grin from ear to ear with excitement. One trip after another, the gifts kept pouring in as the Fahlgrens retrieved more and more goodies from their jam-packed vehicle. John Fahlgren is an LFYO partner and the owner of Sow Plated. Located in Upper Arlington, this is our favorite restaurant in Central Ohio. Great Food = Good Mood!

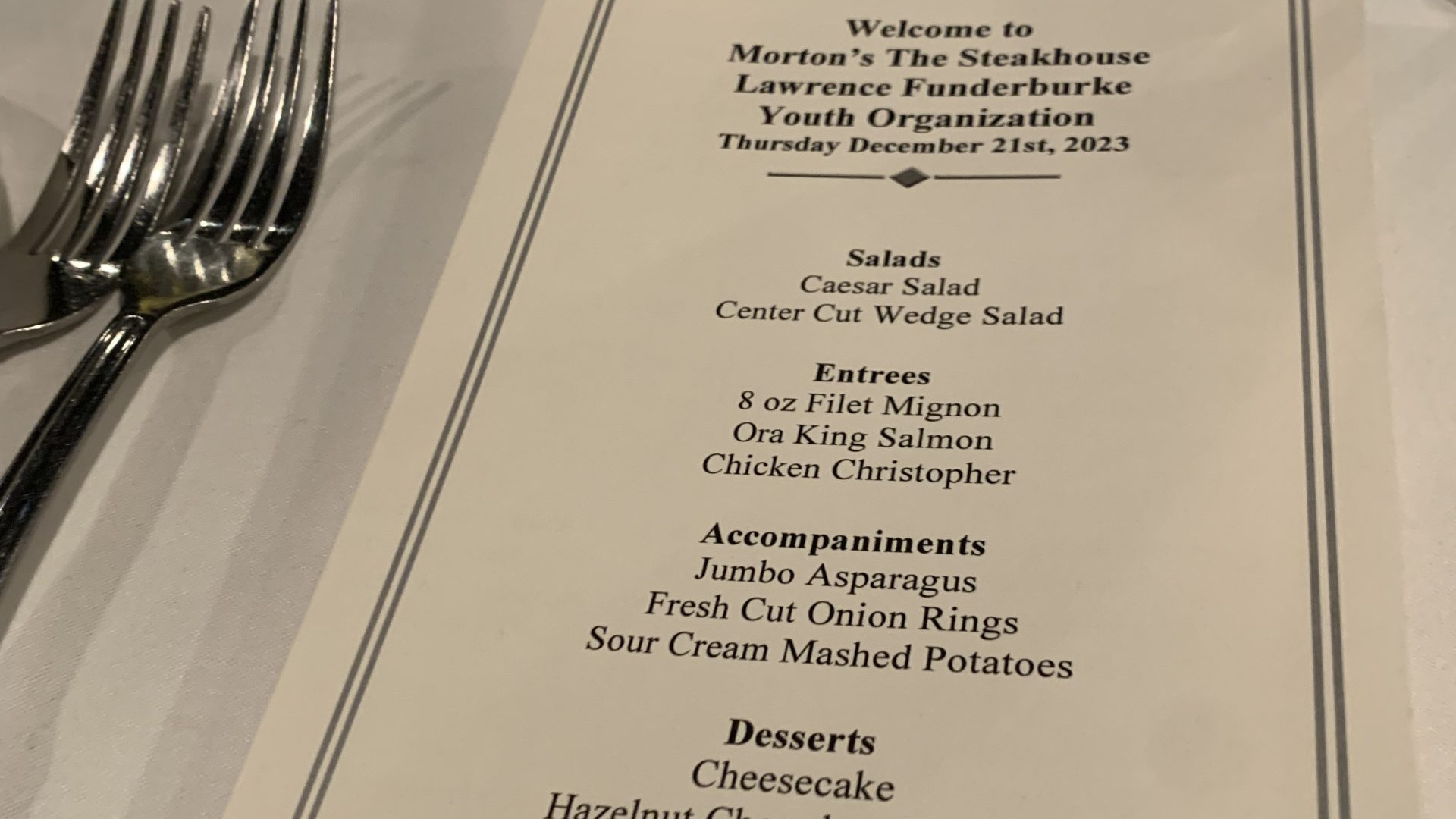

NBA Basketball Experience

Lastly, let’s talk basketball. Tom Warner was the auction winner of The Cleveland Sports Package at our fundraising event, which included a four-course dinner at five-star Morton’s Steakhouse and lower-bowl tickets to watch the Cavs play the New Orleans Pelicans on December 21st. Cavs legend, Campy Russell, donated the tickets; our seats were five rows behind the Pelicans bench. (Included in the photos are Tom, his son Grant, me, and my son Eli.)

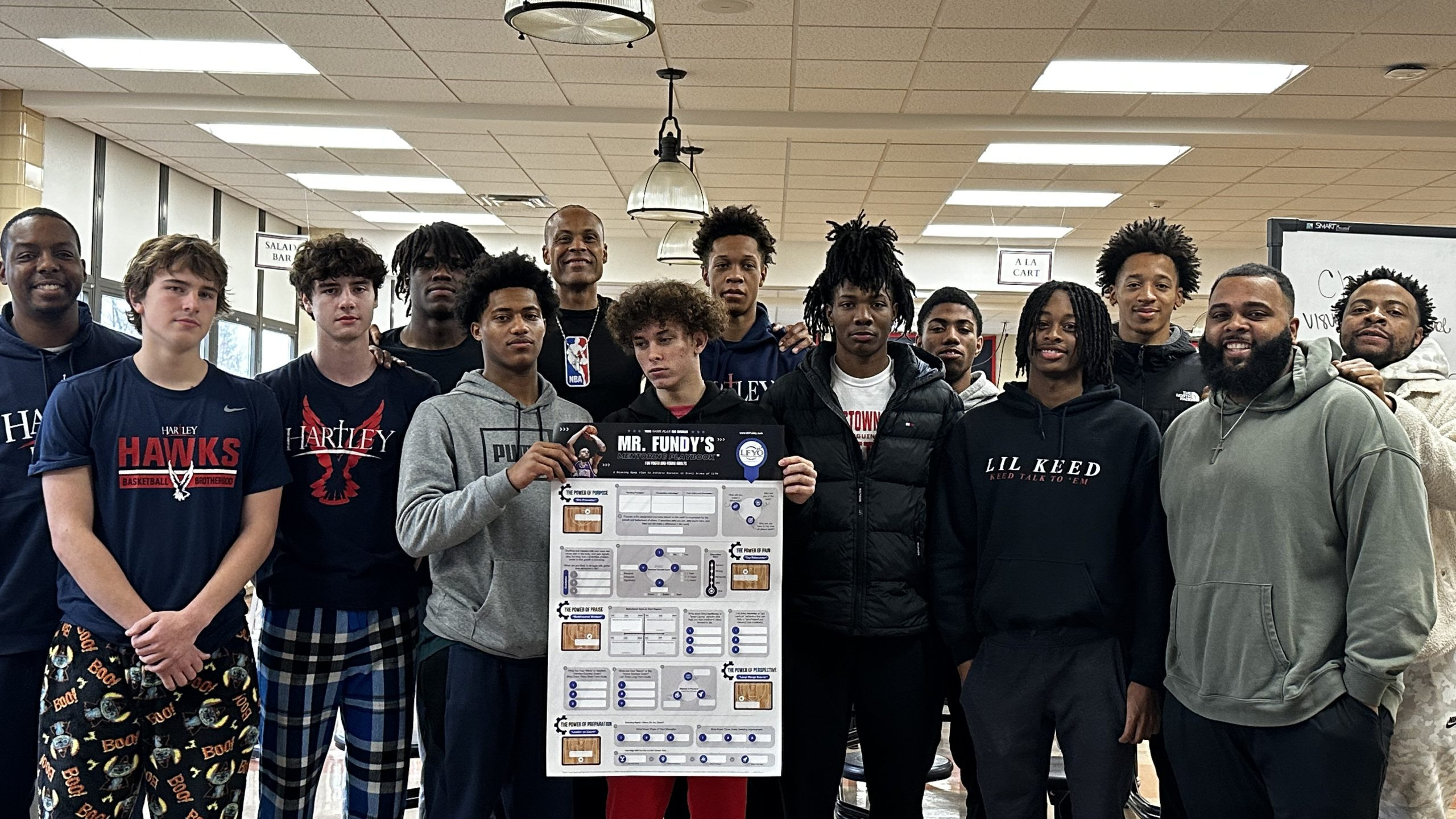

High School Basketball and Mentoring Program

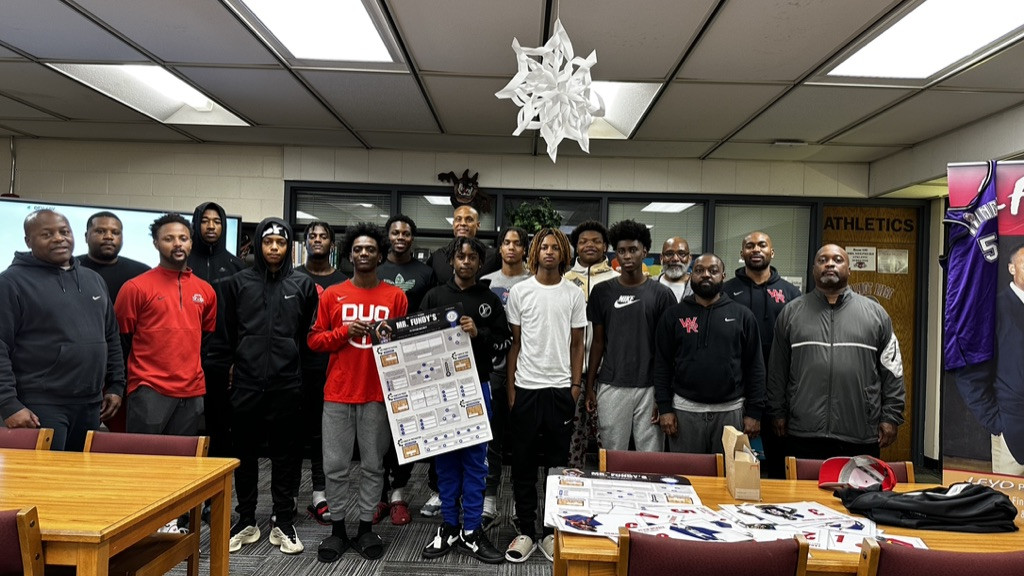

The year ended with the launching of LFYO’s new initiative, The Mr. Fundy’s Mentoring Playbook for Youth and Young Adults. Mentoring concepts are crystallized through basketball terminology. Monya and I presented three workshops for the coaching staff and varsity boys basketball teams at Hartley, Walnut Ridge, and Africentric, respectively. Players were fed a deliciously healthy meal, shown how to identify and articulate their personal brand, and given the template for lifelong success as outlined in our mentoring playbook poster. I’ll share more insights on mentoring in a five-part series throughout this month. January is National Mentoring Month. Time for you-me-us to step up our influence game personally, professionally, and philanthropically.

Bishop Hartley Varsity Boys Basketball

Walnut Ridge Varsity Boys Basketball

Africentric Varsity Boys Basketball

Deliciously Healthy Brunch

With your support, we can continue to make a real difference in the lives and legacies of vulnerable communities

The Power of Mentoring – Giving Tuesday

Giving Tuesday

November 28, 2023

The Power of Mentoring

How an Attitude of Gratitude Can Transform Our Central Ohio Community

Giving Tuesday is one week away, a global movement with local momentum to change lives and transform legacies. Here’s where your help comes into play with a much-needed assist. On Tuesday, November 28, The Columbus Foundation will cover all fees for gifts made by credit card through The Giving Store to support the Lawrence Funderburke Youth Organization. So, 100% of EVERY tax-deductible donation made on this date through The Columbus Foundation will go directly to LFYO!

Outside of a parent or family member, who has had the biggest influence in your life personally, professionally, or philanthropically? It’s probably safe to say that this person or group has served as a trusted mentor, a relatable and reliable tour guide with a proven track record in producing verifiable results in your life. Without this guidance-counselor relationship and success GPS system, where would you be? Now, imagine what life is like for at-risk youth who have been shortchanged from birth to adolescence in the area of effective mentoring. I’m not making excuses, but these young people are likely going to take their pain out on others, or themselves, or take matters into their own hands (a la Kia Boys) to navigate their brutal existence. And a young mind is ill-equipped to carry this burden alone.

We fell short of our $250,000 goal in raising funds at our 2023 LFYO Fundraising Luncheon by $100,000. We’re still hopeful that we can achieve our capital objectives by year’s end. Why? Because you’re assist, really investment, will help us serve over 5,000 participants through the Mr. Fundy’s Mentoring Playbook for At-Risk Youth and Vulnerable Young Adults. In fact, some of the mentees will serve as peer-to-peer mentors and receive compensation for their efforts. Money can act as an incentive, but development activates the real reward.

In closing, peer-to-peer mentoring, or what I term, horizontal influencing, is about the village elevating the village. This can occur by pushing, pulling, or propelling each other across the success finish line. Adults can serve as facilitators of youth-led change, but the workload rests with the initiators of transformation — peers who look, think, and act like them. Yes, we can provide the appropriate guidance and applicable guardrails, but grown folk need to step aside and let our young people get in success shape through peer-to-peer coaching, conditioning, and cheerleading measures. And the life and legacy game, theirs and ours, is truly on the line. (The Mr. Fundy’s Mentoring Playbook for At-Risk Youth and Vulnerable Young Adults has been praised by Zack Klein, Columbus City Attorney.)

Thank you for your time, talents, and treasures as LFYO difference-makers and philanthropy mentors!

Click the button below to help us reach our year-end fundraising goal through The Columbus Foundation Giving Store.

Chillicothe Wellness Workshop

Chillicothe Wellness Workshop

In Appalachia Ohio, 10 percent of the population are people of color, and yet, this demographic only receives 3 to 4 percent of the outreach dollars to impact this vulnerable area of the state. In partnership with the African American Community Fund, which exclusively serves Appalachia Ohio, LFYO presented a four-hour wealth and health workshop for black and brown Chillicothians on August 12th. Given the fact that my wife Monya grew up there as a child, this place is near and dear to my heart. Like so many southern Ohio towns, Chillicothe has seen its middle-class lifestyle become more and more constrained by factors outside and inside their control. They’ve also watched their most marketable quality — a rock-solid work ethic — result in less and less residual benefits. Blue-collar jobs lost in the 1980s due to global outsourcing forces to produce cheaper products at lower wages was the unfortunate catalyst. The resulting fatherless crisis (driven by purposeless adult males), drug dependency epidemic, and overall hopelessness have crippled the region. It’s a tale of two vastly different worlds. A shrinking minority have capitalized on an oasis of opportunities as risk-seeking entrepreneurs, real estate investors, and revered philanthropists. The expanding majority view life as one painful voyage with little hope for a promising future but full of legacy-altering, coulda-woulda-shoulda regrets. To most Appalachia Ohio residents, their opportunity glass is always half empty.

Our empowerment goals were clear-cut throughout the wellness workshop. Teach participants the language, lingo, and labeling of wealth and health through sensory-based approaches. All three — language, lingo, and labeling — embrace personal discomfort. Of course, no growth can occur without an upgraded mindset. An individual’s expectation of the future changes when exposure and experience are both transformed in the present. And it’s hard to get someone excited about a future that hasn’t been seen before. Thus, we familiarized participants with the investment world, a key pillar of a well-constructed financial plan. Investing is arguably the biggest stumbling block for any racial demographic, especially those who suffer from “math anxiety.” Investing in math is complex, but it doesn’t have to be complicated. Of course, it can serve as a compound interest friend or foe. (The bulk of the workshop was spent on investing. Typically, blue-collar communities instinctively understand the basics of personal or family finance — live below your means, avoid unnecessary debt, and maintain a respectable credit score. But most middle-class households in rural Ohio know very little about the stock market, even when working for recognizable, publicly traded companies.)

First up was The Portfolio Management Game, one of our signature learning modalities to bridge the growing and glowing opportunity divide in America. This PDF app crystallizes the world of investing in a language that’s relatable, palatable, and sustainable to every social class group. Each player is given $1,000,000 to invest in various investment options, including cash/cash equivalents, stocks, bonds, mutual funds, index and exchanged traded funds, private equity, and hedge funds. At the onset, though, an analysis of one’s risk tolerance and financial goals serve as key drivers of portfolio construction decisions. Participants must wait with bated breath as they watch how global economic factors and conditions impact — positively or negatively — their million-dollar portfolios on a macro level through four scenarios. Of course, taxes, inflation, diversification, and asset allocation are additional considerations of this real-world, simulated game.

The Portfolio Management Game was the perfect segue into the Mr. Fundy’s Stock Pro Game, a hypothetical investment game with both macro and micro components. Participants assessed the dynamics of large-cap, mid-cap, and small-cap stocks from a value-investing perspective. Each participant was given $1,000,000 to invest in five companies, which consisted of 10 large cap, 5 mid cap, and 5 trim cap options. From banks to airliners to software developers to clothing and apparel manufacturers as well as other industry categories, participants admitted that selections were made based on their “familiarity profile” — what they knew, who they trusted, and how they shopped in terms of products and services. Key metrics in the Mr. Fundy’s Stock Pro Game included earnings per share (or EPS), price-to-earnings ratio (or P/E ratio), dividend yield, return on assets (or ROA), and return on equity (or ROE). They were shown how to calculate market share (stock price x # of shares outstanding). Also, participants were taught how to find the missing variable in an algebraic equation when two out of three variables are known. For example, if earnings per share and number of shares are stated, then total earnings or net income can be found through deductive reasoning.

As a race, we’re behind the ball financially. And not much has changed for our wealth picture since The Emancipation Proclamation of 1865, which supposedly set us free. Blacks spend more money on food, clothing, and entertainment than any other ethnic group. What we touch as loyal consumers, we usually buy based on how it’ll make us feel. Who we wear regarding designer labels, in our minds, plays a large role in how we’re viewed, accepted, or denigrated in the eyes of others. Where we find laughter and enjoyment, is how we escape from our real or imaginary pain. As U.S. congresswoman Joyce Beatty once shared with me several years ago, “We, black folks, need to be on both sides of the cash register.” It’s time for us to break free from what holds us back as a people — feeling a certain way before we do a certain thing. Feelings can serve as a barometer, but they inevitably make a terrible guide. In the last hour of the workshop before Chef Jim Warner’s cooking demo, rule-of-thumb averages were highlighted in the five areas of comprehensive financial planning using a case study as the backdrop: life planning, financial management, investment planning, income and asset protection, and estate planning. (In general, it takes a minimum of 20 hours of intensive training to construct a viable foundation in personal or family finance. And scaffolding attributes to accumulate, protect, and distribute legacy wealth involve countless hours more.)

Chef Jim Warner wrapped up the workshop with a stellar presentation on healthy eating. Over the years, he has prepared meals for Kirk Herbstreit, Joey Galloway, Michael Redd, “Beanie” Wells, and yours truly. He discussed the important role nutrition can play in the lives and legacies of those who prioritize wholesome eating. Yes, it’s a matter of life or death every time we sit down to eat. Real food helps us think better, feel better, and do better. Warner highlighted, “Start today by making small changes in what you eat and drink.” He added, “Pay the price now so that you can reap the rewards later.” Every delicious food item prepared by Chef Warner was gluten-free, GMO-free, dairy-free, additive-free, soy-free, and pork-free (but not taste-free). Organic foods may cost more, but the benefits far exceed conventional alternatives. Even on a limited budget, quantity and quality of life are greatly improved when consuming foods that are good for the brain, belly, and body. Pay now, play later. Or, play now and pay later. Doesn’t matter if it’s our wealth condition or health status.

2023 Legacy Transforming Summer Program - Week 7

Week 7

Legacy Transforming Summer Program

In Week Seven, the Mr. Fundy’s Stock Pro Game took center stage for our in-class activity. This hypothetical investment game provided the young men with another opportunity to gain real-world financial skills while assessing the dynamics of large cap, mid cap, and small cap stocks. Each participant was given $1,000,000 to invest in five companies, which consisted of 10 large cap, 5 mid cap, and 5 small cap options. From banks to airliners to software developers to clothing and apparel manufacturers as well as other industry categories, these young men were given a behind-the-scenes tutorial on how to select winning stocks that aligned with their “familiarity profile.” My wife and I will also gift each young man with one share of stock in a local publicly traded company to get him started down the wealth-building path. Key metrics in the Mr. Fundy’s Stock Pro Game included earnings per share (or EPS), price-to-earnings ratio (or P/E ratio), dividend yield, return on assets (or ROA), and return on equity (or ROE). They were shown how to calculate market share (stock price x shares outstanding). Also, they were taught how to find the missing variable in an algebraic equation when two out of three variables are known. For example, if earnings per share and number of shares are stated, then total earnings or net income can be found through deductive reasoning.

Now, math is a subject that often terrifies at-risk communities because of painful, negative experiences. As they advance up the math continuum, by and large, so does their level of discomfort. Thus, pain and math are positively correlated in terms of saliency. Why embrace a subject that can be construed as an indictment on a representative group’s frontal lobe development? My tagline: “You don’t have to love math but you better respect it. Why? It’ll either work for or against you in the form of compound interest as an investor or debtor.” That’s why financial education is so important for this demographic. And what better way to demystify math while playing a fun game using various scenarios that help disadvantaged populations make the right moves educationally, financially, and inspirationally as their investment portfolios rise (or fall) through macroeconomic forces. The winner of the game after four macro scenarios was Gavin G., a high school senior. He increased his portfolio by almost $290,000 or 29 percent. That’s an impressive return by anyone’s standards! Kudos to Nate Palmer of Diamond Hill Investment Group for helping me fine-tune the Mr. Fundy’s Stock Pro Game, which took Monya and I roughly 90 hours to create over several years. In fact, every PDF game within our customized wheelhouse has to be exciting, thought-provoking, and transferable in scope and reach to empower a particular audience.

The Mr. Fundy’s Stock Pro Game was the perfect segue for the next item on the day’s agenda, a lesson in fine-dining etiquette at my (and Monya’s!) favorite restaurant here in Central Ohio — Sow Plated. As frequent patrons, the food is reasonably priced, exquisitely prepared, and exceptionally beneficial for the brain, body, and belly. And as mental health challenges engulf our society, sound nutrition can (and should) play a large role in alleviating them. “Real food” — what’s served at Sow Plated — is the medicinal remedy to combating the harmful side effects of “fake foods.” Located in Upper Arlington, this was the first time many of the young men had ever visited this part of town. Think about that for a moment. Now to the five courses served on July 27th. The first course, appetizers, included maple sweet chili cauliflower and edamame dumplings. Yummy! The second course, a savory market soup with seasonal ingredients. The third course, a delicious spring salad. The fourth course, a wagyu burger, mediterranean bowl, or teriyaki bowl as the entree. The fifth and final course, a flourless cacao cake for dessert. Am I making you even more hungry? Founder and owner, John Fahlgren, discussed his heartwarming story with the group as a West Virginia native. He echoed a recurring theme that I’ve highlighted throughout with the young men: “The best investment you can make is in yourself.” They nodded in agreement while feasting on a nutritious meal, unforgettable experience, and the words of wisdom from an incredibly generous host.

Next up was a surprise trip (like Sow Plated) to The Ohio State University. Unbeknownst to them, the visit included a sit-down discussion with Athletic Director Gene Smith for 45 minutes and private tours of Fisher College, Schottenstein Arena, and the Woody Hayes Athletic Center. Smith discussed his blueprint for success with the young men, including lessons learned as a young and seasoned athletic director in Division I sports. His humility and transparency in sharing sensitive information mesmerized all in attendance, including me. Arguably the most decorated Division I AD in America, Smith carved out time in his busy schedule to help our young men pave their life path. Two recent Fisher College graduates and current ambassadors, Julian Slate and Caleb Suh, provided our group with a tour of the OSU School of Business. Given their close age to our young men, this helped tremendously as attention spans never waned. Polished and poised, Slate and Suh represented Fisher College well in both word and deed. I am certainly proud to be a Fisher alum!

We toured Schottenstein Arena, including the Hall of Recognition for men’s and women’s basketball players who wore the scarlet and grey uniform. We stepped onto the practice court of both the women’s and men’s teams. We were then treated to a lively meet-and-great with Chris Holtmann, the men’s head coach. He encouraged our young men to see the positive even in the midst of difficult circumstances. Our last stop at O State was the Woody Hayes Athletic Center, so named after the iconic legend who admonished all of us “to pay it forward.” Former OSU great and current defensive backs coach, Tim Walton, treated our group to an amazing tour. The national championship trophies, wall of NFL draft jerseys, and prized football legacy captivated their (and my) attention. We walked onto the in-door practice field and met Lathan Ransom and Denzel Burke, two OSU top-rated defenders. We even shot some hoops on the basketball court adjacent to the practice field. Yes, I had to show the group that I could still play — a true baller never retires. As we exited, Walton shared, “It was such a blessing to have you visit the facility. This experience might have made your day, but you made mine.” A first-class coach representing a top-tier university. Go Bucks! Stay tuned for Week Eight.

Sow Plated

OSU Athletics

Fisher College of Business

Related Articles

Nothing found.

2023 Legacy Transforming Summer Program - Week 6

Week 6

Legacy Transforming Summer Program

Week Six was all about field trips. We visited Continental Office first, a Central Ohio company specializing in ergonomic furnishings, custom flooring options, interior construction solutions, and brand management of office spaces. Inviting work places can lead to greater productivity, stellar employee morale, and higher overall job satisfaction by associates, among other noticeable benefits. Kim Bodrick, Nicole Lanier, and Gina Frazier provided the young men with a tour and an unforgettable, two-hour experience. This trio taught our group how to assess areas of strength, find common ground in generating ideas, collaborate individually and corporately as a unified team, resolve conflict and diffuse personality clashes, stay within budget (based on design parameters outlined by the hypothetical client), and leverage their creative skillsets. The four teams had five minutes to present their design, with the winning team receiving an AMC movie card for each member. As the video recap highlights, healthy competition brings out the best in our young men. After starting off slow, what a blessing it was to watch them embrace such a challenging opportunity with so many moving parts.

Our second field trip was to Midwest Photo, which is the largest photo, video, audio, and printing specialty store in Central Ohio. And if you think (like I did) that photography has been on a sharp decline as smartphone cameras have exploded over the last decade, you would be mistaken. This company has been thriving with consistent business from Fortune 500 firms to midsize organizations to freelance entrepreneurs. Taylor Cubbie, Steph Parker, and Jim Andracki were our gracious hosts. No pun intended, but our young men lit up and cut up in front of the camera. They expressed a wide range of emotions while reflecting on their individual photo shoots. They were joking, laughing, and at times, even being serious. Taylor Cubbie presented each young man with a photo shoot media card. He also showed them how to monetize their personal brand on social media with a shoestring budget. Cubbie even allowed one of the participants to take pictures with his $3,000 camera! Steph Parker showed the group how to operate video equipment for podcast recording. I initiated a discussion on the state of affairs of our inner-city males. We had a lively and candid conversation on The Kia Boys. The dialogue continued as this controversial topic was broached: Why do you feel the older generation in the black community is so out of touch with your age demographic? In decades past, elders were granted respect without giving it. That outdated model won’t work today; respect is now a two-way street. By and large, most Baby Boomers (and even Gen Xers) are terrified of and simply can’t relate to inner-city youth. They’d rather fight over behavior changes instead of fix misguided mindsets. To win the black culture war, we must be willing to lose a few timely battles along the way. Sagging pants, foul language, and bad grammar are outward signs of inward pain signals. Bind the wound to stop the hemorrhaging.

We ended the day at God’s Hygiene, which provides personal care products to economically challenged families in the Linden area. Jim Andracki, a photography legend at Midwest Photo and committed philanthropist alongside his wife Brenda, helped us with this field trip. Our visit to God’s Hygiene involved three components. First, underprivileged (and privileged) young people need to focus on how they will make our world a better place. Why wait until adulthood before the charitable lightbulb turns on? Time and talents are just as important as treasures in the stewardship equation. Second, I want them to understand that “free” comes with it’s share of costs. Benevolence ministries, summer camps, and skill-trade programs are expensive. As receivers, this fact often gets lost in translation. Third, giving back can boost oxytocin levels. This biochemical superstar combats stress, enhances the immune system, and improves mood. By thinking about the progress of others, they inevitably help themselves in the process. Stay tuned for Week Seven, which will be full of surprises!

Related Articles

Nothing found.

2023 Legacy Transforming Summer Program - Week 5

Week 5

Legacy Transforming Summer Program

Week Five might have well been a paradigm shift or pivotal moment for the young men. Why? I invited more than a dozen friends across racial backgrounds and occupational paths to share their story with the group on topics ranging from marriage (and unfortunately divorce) to fatherhood to lessons learned while being incarcerated. Thanks in large part to The Law of Authenticity, pastors, pro athletes, and professors shared engaging insights that resonated with the young men. Transparency is the key to helping people break free from what’s holding them back. Men who aren’t afraid to be vulnerable have the opportunity (but not the guarantee) of becoming relatable, reliable, and recognizable mentors. Imposter syndrome is a real phenomenon that engulfs far too many of our privileged and underprivileged males. So many men reach adulthood but fail miserably in their transition from adolescence. I speak from personal experience. Whether in inner-city or suburban communities, without a rite of passage from boyhood to manhood, we all pay a heavy price when this is noticeably or inconspicuously absent. Yes, Week Five had a lot of fireworks; no topic was off limits. Too much is at stake to skate around hot-button issues. Don’t worry. Guidelines and guardrails are always taken into consideration when I, or any invitee for that matter, address young people.

You’ve probably heard of The Kia Boys, young males, African American in most instances, who steal Hyundai vehicles for the dopamine-, adrenaline-, and endorphin-driven thrill ride. Perhaps a bit controversial, here are three observations to explain their behavior pattern. First, in the majority of cases, these youngsters are (or were) reared in fatherless homes. Without a paternal tour guide in close proximity, it shouldn’t come as a surprise for these teens and tweens to take the wheel of aspiration themselves. To be seen and to see what that “success ride” feels and looks like is their modus operandi. Please note: Fathers are hardwired to provide children with drive, determination, and discipline. Anecdotally this is known by most of us, but biochemically I can prove it while working with more than 30,000 youth over the past two decades. In general, when a fatherless teen living in a feast-or-famine environment reaches puberty, testosterone surges need to be carefully modulated in a maturing body. If dad or a surrogate father-figure is not present, who steps in to monitor the androgen GPS system? Most of the time, negative influences enter the picture to play Big Brother, Big Baller, or Big Brawler roles in the ’hood. They may not be ideal, but drug dealers, gang bangers, and hook-and-crook cliques do provide an outlet for “ghetto-life vents.” Second, The Kia Boys are often deprived of positive, peer-to-peer relationships and adult role models. They aren’t typically connected with a sport’s team, after-school program, or structured setting at home. An idle mind is the devil’s playground. Thus, stealing cars is The Kia Boys’ de facto, extracurricular activity. This initiation, really, a rite of passage by default, allows first-time or even seasoned offenders to earn their street cred. Approval — in the form of eyeball hugs, signature hand daps, and bonding feedback loops — is what they crave. The source of affirmation doesn’t matter; it just needs to be given in adequate doses by willing participants. Third, each Kia Boy is searching for a customized identity or personal brand. Of course, fathers should play the lead role in helping children know who they are, how they’re gifted, and what their contributions will be to the world. Interestingly enough, the word kia means “to rise up” in Korean. Is it a coincidence that this phrase, or similar ones, has served as the inner-city anthem to escape that lowly place of _______________? I’ll let you decide and fill in the blank also. One thing you and I can agree on is this: our most vulnerable males need vision. Without it, the Good Book states, “the people perish” or cast off restraint. And drive, determination, and discipline are held in check by vision. Western cultures, notably America, are digging their own legacy grave by neglecting the father’s blessing. The carnage is everywhere. I don’t want anyone’s blood on my hands. How about you?

Wanna be pro athlete or want to be a pro athlete? No, this isn’t a trick question. Spotlight careers (really high-profile jobs) such as pro sports are attractive to at-risk males. The fame. The fortune. The fanfare. However, very few of them understand what it takes to make it, let alone play, at the highest level. So, I provided them with a taste of a condensed workout — without any weights. ESPN highlights are a mirage; the best clips are edited for maximum audience enjoyment. The behind-the-scenes workouts and grueling practices of big-time, competitive sports rarely make the cut. And during the off-season, most pro athletes spend a significant amount of time on athletic development rather than sport-specific improvement. Here’s a secret I share with parents and their children who train with me: If you’re a better athlete, then you’ll become a better player. No doubt, active bodies with purposeful intentions can deactivate reactive minds. Consistent exercise with weight training can reset an out-of-whack circadian rhythm, boost a depleted neurotransmitter system, and fuel happy hormones in our vulnerable males. Yes, there’s a method to my madness.

When a young man’s internal biochemistry is jacked up, he will go on a campaign to get his fix by any means necessary. Through a drug, drink, drift, drive, or drill (as in music). Chef Jim Warner, who has prepared meals for Kirk Herbstreit, Joey Galloway, Michael Redd, “Beanie” Wells, and yours truly, presented an amazing cooking demo for the group. He discussed the important role nutrition can play in their lives. Chef Warner highlighted, “Real food helps you think better, feel better, and do better.” He added, “Pay the price now so that you can reap the rewards later.” Every food item prepared by Chef Warner was gluten free, GMO free, additive free, soy free, and pork free (but not taste free). Organic foods may cost more, but the benefits far exceed conventional alternatives. Even on a limited budget, quantity and quality of life for disadvantaged populations can be achieved when healthy lifestyles are prioritized. Stay tuned for Week Six!

“If it wasn’t for their tombstones, we wouldn’t know that some people were ever alive. Truly great people don’t need monuments because we will always remember them.”

— Dr. Myles Munroe

Related Articles

Nothing found.

2023 Legacy Transforming Summer Program - Week 4

Week 4

Legacy Transforming Summer Program

We’ve reached the midway point of the eight-week, financial life skills initiative to empower vulnerable males aged 16 to 23. It’s been an honor to work alongside the GoodLife Summer Program at First Church. Growth for some of the participants has been steady, but for others remarkably significant as they’ve grasped “new” concepts foreign to their way of thinking. Success in any arena of life isn’t complicated; however, it is quite complex. Semantics matter a great deal when the legacy of our inner-city males is on the line. Underserved populations often view success beyond their borders as incredibly painful, increasingly burdensome, or worst still, entirely unattainable. Based on the roll of the better-life-outcome dice, a few “lucky ones” might escape the harsh landscape of economic misery. But for most residents, “perpetual failure,” in flickering neon lights, is how they envision their life options and legacy outcomes. Half the battle in working with at-risk communities is convincing them to focus on the certainty of possibilities rather than fighting against uncertain impossibilities. Unfortunately, a lot of people just can’t see past their front door. Thus, we realize how imperative it is to transport the young men under our care outside of I-270. There’s more to Columbus than Livingston Avenue, Main Street, Refugee Road (where the in-class programming takes place), or even their neighborhood.

Participants played The Portfolio Management Game, one of our signature learning modalities to bridge the opportunity divide in America through sensory-driven education. This PDF app crystallizes the world of investing in a language that’s relatable, palatable, and sustainable to privileged and underprivileged groups alike. Each player is given $1,000,000 to invest in a myriad of investment options, including cash/cash equivalents, stocks, bonds, mutual funds, index and exchanged traded funds, private equity, and hedge funds. At the onset, though, an analysis of one’s risk tolerance and financial goals serve as key drivers of portfolio construction decisions. Participants must wait with baited breath as they watch how global economic factors and conditions impact — positively or negatively — their million-dollar portfolios on a macro level. Of course, taxes and inflation are additional considerations of this real-world, simulated game. Anne Richie, a business finance instructor at Ohio State University, served as one of our three in-class mentors for the day. Richie is a former banker and current Managing Director of The Mezzanine Fund, which invests exclusively in female-led and people of color (POC) businesses. Her insights shed light on the benefits of investing in black-owned enterprises. Jason Moore, a private equity investor and board president of Cristo Rey Columbus High School, discussed his views on business investment. He’s vested for the long haul; people and culture shape his capital deployment philosophy (or CDP). Lenzelle Smith, Jr., former Ohio State basketball star and member of the 2012 Final Four team, presented the young men with a game plan to reach their short- and long-term goals through practical approaches.

Our first field trip for the day was Fischer-Backus, headquartered in Lewis Center. This manufacturer specializes in wire and cable assemblies for clients across various sectors and industries. Whether quick turnaround prototypes or large volume production runs, excellence and attention to detail are defining qualities of the Fischer-Backus brand. We witnessed this firsthand throughout our 90-minute visit of the facility. Associates were unfazed by the presence of our large group. As outlined in the mission statement, they were locked in to the company’s 100 percent, defect-free product commitment. Owner-operator, Tony Carstens, provided our young men with lunch and a wonderful experience. Given the monotony of assembly-line production, manufacturing doesn’t excite most people. But for some firms and the workers they employ, it is quite lucrative on a per-item basis. With thousands of customized products for each (hopefully repeat) client order, the cash register keeps adding up. Cha Ching!

The art and science behind financial statements kicked off our discussion over lunch. The tug-of-war battle between profitability and productivity in a highly competitive marketplace, Carstens emphasized, should align with customer-oriented goals and organizational-growth objectives. Our young men were introduced to the burden rate, or what the breakeven cost is for a job given a variety of fixed and variable expenses. He highlighted, “With every job you must account for what it takes to pay associates, keep the lights on, and operate expensive machinery.” He added, “If you get this wrong with a customer’s bid, it’ll impact your bottom line or net profits substantially. Got it?” They nodded in agreement. We toured each area of the facility and ended the day with hands-on training. Each participant was given the opportunity to test his manufacturing skills at two of the work stations. They were thrilled!

Aurora-Exhibits was our last field trip for the day. Founder and CEO, Joan Gaudion McKinney, assisted our young men in her area of expertise — branding. “What begin in 1994 as a trade show exhibition house,” the website highlights, “has grown to a three dimensional brand awareness agency.” From idea generation to visual graphics to interior branding of high- and low-traffic corporate spaces, the company has helped hundreds of clients with their brand engagement needs. From Fortune 100 firms to small mom-and-pop organizations such as LFYO, Aurora-Exhibits offers a compelling value proposition during good and bad economic times for enterprises to stand out. Thanks in large part to McKinney, she adds a “happiness touch” that few CEOs can pull off. Why? Because she relates well with people from all walks of life in an upbeat manner, which of course, is a highly specialized skillset. Our group embraced the lesson plan and were challenged by McKinney’s personal and professional branding call-ups, not call-outs. She shared, “Gentlemen, your individual brand can serve you well at a company if it’s marketed correctly. Always take the responsibility seriously since a great one will carry you to new heights in every endeavor of life.” We finished the day at Aurora-Exhibits with a two-team, tricycle race. The young men did what they do best on the oversized tricycles; they competed for bragging rights among their peers. Healthy competition is a vital key to keeping vulnerable males on the right course. When they drift from it, society often follows suit. Stay tuned for Week Five!

Related Articles

Nothing found.

2023 Legacy Transforming Summer Program - Week 3

Week 3

Legacy Transforming Summer Program

Something amazing took place in week three. That lightbulb moment clicked for many of the young men to see their distant future through a present-day lens. Here’s what I mean. Proximity to success holds the master key to unlocking it. And the closer they are to it — however success is defined — the more tangible or real it becomes to them. Inner-city communities don’t have a capability issue; they’re stuck on the ground floor due to an accessibility problem. The young men under my tutelage are experiencing success up-close and personal, thanks in large part to our sensory-driven learning modules (or game-based PDF apps), career role models, and life-altering field trips. Rest assured, though, success is not a resting place; it’s a lifelong journey.

From the jump, it was a full-court press in class. Dr. Lucia Dunn, a retired sports economics professor at Ohio State, stopped by to share insights on the intersection between labor and fair pay. In short, compensation is often shaped by one’s marketable value proposition or personal brand statement. Next up was a riveting discussion on the fundamental difference between movements and moments that have defined America over the last decade. With a movement, you can opt out. But with a moment, you can only opt in. Step up or shut up. Creating unforgettable moments is arguably the most critical factor (and facet) to bridge the growing opportunity divide in America for touch-and-feel, black and brown communities. Of course, this means we all need to change our approach and descent to land the opportunity plane to allow every American to get on board. When we point fingers at others, we have three pointing right back at us. And nothing changes until we do, which is why the lesson on personal branding or success stepping was so critical for our vulnerable males. Shifting from the emotional to the rational is a delicate balancing act when working with drifting minds. The former can get their attention, but the latter will keep their focus on the task at hand.

Located in Gahanna, our first field trip was to Advanced Civil Design, a firm specializing in civil engineering and land surveying. Why would we transport inner-city males to an engineering company? Well, the foundation of success must be laid first before the framework for it is built. Founding owner, Tom Warner, provided our group with lunch and an overview of his company’s expertise in helping clients fulfill their vision. Whether it’s an office building, retail space, senior living community, medical complex, or multifamily development, vision serves as a “seed deposit” or down payment for a project. Here’s what kickstarted their dream currency at Advanced Civil Design. As the guys exited the elevator to the third floor, their innate, God-given vision kicked in as seed-bearers. A blank canvas or empty space with thousands of square feet supercharged their imagination skills. A few of them separated from the group for personal introspection, while the rest shared their ideas with one another for the space. Eventually, every one of them walked over to the massive windows to view their lives from a different vantage point. Words could not accurately describe how I felt as watching them from a distance.

Our last field trip for the day was to the Center of Entrepreneurial Development (or COED for short). Founded by visionary Derrik Pannell, the four-story building located on 1890 East Main Street serves as a hub for aspiring black and brown entrepreneurs who face unique barriers in building thriving businesses. Pannell discussed the rebranding pivot, or getting back on track when facing a monumental setback. He added, “You can’t let other people’s opinions prevent you from moving forward in life when falling short. Too much is on the line to allow this to happen.” Attorney Eric Seabrook, a personal mentor of mine and Pannell, provided a thought-provoking lesson on the value of a name using iconic brands such as Nike and LaCoste to drive home his point. One of the participants blurted out, “I don’t know who Henry LaCoste is, but I do know his brand.” Seabrook asked them, “What do you want your name to be known for twenty-five years from today? A name can have a lasting or fleeting value based on one’s body of decision-making through various quarters or seasons of life.” Seabrook reiterated a comment highlighted earlier in the day on being adept at playing and understanding the rules of success. He stated, “Time will expose your legacy based on what variables you influence or control today.”

Related Articles

Nothing found.

2023 Legacy Transforming Summer Program - Week 2

Week 2

Legacy Transforming Summer Program

The second five-hour session with at-risk males, ranging in age from 16 to 23, took place last Thursday. “At risk” is a term fraught with negative implications and seemingly insurmountable odds. It’s typically used to describe a group, in this case, most notably inner-city males, as potential casualties in the life outcome arena. Fatherlessness, hopelessness, and at times, feelings of worthlessness often engulf this demographic given their economic plight and gravitational pull to veer off course. The latter will not happen under my watch as Papa Coverage; paternal blessings are required to help these impressionable young men fulfill a life of purpose and legacy of promise. The in-class lesson for the day included a macro introduction to the world of investing. Fundamental differences exist among wealth-building tools, including certificates of deposit, bonds, stocks, mutual funds, real estate, private equity, commodities/precious metals, and crypto currency. As risk increases along the investing continuum, so does return. And no, playing the lottery wasn’t an investment option for them to select! Here’s what these young men quickly realized: real wealth takes time to materialize, especially the selection of value stocks.

Made famous by Benjamin Graham and Warren Buffett, value investing is the art and science of discovering “hidden gems,” or finding stocks selling at a discount (significant in many cases) to their current market price. Value investors assess a company’s moat, meaning, management, margin of safety, and motivation in generating appreciable profits and profit margins to derive at intrinsic value, or what a stock is actually worth. Thus, we visited Diamond Hill Investments for an up-close and personal lesson on value investing. Nate Palmer, a portfolio manager and research analyst with CFA and CPA credentials, provided the group with a value investing tutorial using Nike as the backdrop. The young men were fed a delicious meal and nourished by Palmer’s words of wisdom on how to build sustainable wealth. The challenge? Being patient with a process that punishes the emotionally driven. Our next field trip was Luxe 23, a premium luxury apartment building in the Short North. Arranged by The Robert Weiler Company, the building owner, participants were given a private tour of the premises by the property manager, Teena. Living large isn’t cheap. But as my wife Monya likes to say, “You get what you pay for.” I will not allow the young men under my watch to trip over the low bar of mediocrity nor make excuses for what’s not possible. With the right financial game plan, they can achieve a prosperous life down the road if (when?) they make the right moves today. Speaking of making the right moves, former OSU football great Mike Doss and current sales and leasing agent with The Robert Weiler Company, shared his inspirational story with the group. Check out the video above to view this unforgettable experience.

Related Articles

Nothing found.

2023 Legacy Transforming Summer Program

Week 1

Legacy Transforming Summer Program

LFYO presented a five-hour workshop for at-risk males ranging in age from 16 to 23 to keep them off the streets and out of harm’s way. In partnership with First Church and the City of Refugee GoodLife Foundation, this eight-week program will help young men gain valuable skills to secure employment, build self confidence, and find (and fund) their life’s purpose. On June 15th, participants played the Money Ballin’ with the Pros and Buying a Dream Car customized, interactive PDF games. These real-world tools allow young men to dream big, make big money, and more importantly, avoid big problems now and down the road. We then transported them to the Toy Barn so that they can see, touch, smell, and plant the fruits of “proximity” success. And it’s hard to taste success without first experiencing it up close and personal. Owner Shawn Cunix, an Independence High School graduate, shared his keys to success via FaceTime with the young men. They were glued to his every word! Sales manager, Greg McDevitt, provided the group with an unforgettable tour and offered behind-the-scenes knowledge on how to start their career off on the right foot. These memories will last (and can be leveraged for) a lifetime. Lastly, it’s okay to have money, possessions, and wealth-generating assets as long as they don’t have you. Check out the day’s activities and stay tuned for next week’s recap on investing:

Related Articles

Nothing found.