LFYO 2024 Summer Programming

June 25, 2024Articles,summer 2024

LFYO has teamed up with the GoodLife Foundation and Columbus Parks and Recreation to present several weeks of summer programming for area youth. For vulnerable populations, it’s critical to offer positive outlets since negativity permeates their tumultuous landscape. One thing is certain: We must keep our kids safe and out of harm’s way. Financial life skills not only improve favorable outcomes for at-risk youth, but they also serve as violence prevention measures. You see, the biggest difference between disadvantaged teens and their well-to-do peers comes down to opportunity. Successful careers, success templates, and success-oriented mindsets are par for the course in affluent (and even upper middle class) communities. And this is why their children have a distinct, modeling and networking advantage. That’s why LFYO serves as a bridge-building specialist to help level the playing field without settling a score. In other words, leveraging the three E’s of success is the key to closing the opportunity gap. Exposure. Experience. Expectation. Expose vulnerable participants to what can be, provide the tools or experience to achieve it, and watch what happens. The expectation to do better feeds itself when they’re fed a smorgasbord of real-world opportunities (which is a beautiful thing to behold when at-risk youth who once felt disempowered now value empowerment). This is how we change lives and transform legacies, one broken spirit and battered soul at a time.

I see myself as the modern-day version of Robin Hood. No, I don’t steal from the rich to give to the poor. What I do is borrow from the wealthy and well-connected to empower the less fortunate.

Thus far, we’ve taught underserved youth how to create (and protect) their personal brand, identify their unique life-and-flow fit, and improve their mental health status. Plus, the young ladies are treated like royalty. They are always served first when eating, and the fellas must hold the doors when females are entering and exiting every company we visit. Yes, we’re bringing back chivalry, and those who fail or forget to comply must do 25 (super-slow) pushups! In fact, young people can learn anything if it’s memorable, manageable, and marketable with (or to) their way of thinking. What’s memorable draws upon hope. What’s manageable provides the help. And what’s marketable fuels the hype, or what it takes to get them fired up about their promising future. As Cubbie Taylor remarked after hosting our group on a field trip to Midwest Photo, “This is the most impressive collection of young people that I’ve ever had the pleasure of working with, and I have hosted hundreds of children before.” Jason Moore, owner-operator of Autotool Inc., echoed this sentiment. Among other things, he highlighted, “Wow, what an amazing and articulate group of teenagers!” It’s not a capability issue with our most vulnerable, black-and-brown youth; it’s an accessibility problem. Take a look at the pictures, videos, and lineup of activities below …

Exposure

The state of being in an environment or situation where one is subjected to a particular agent, influence, or experience.

Experience

The practical knowledge, skill, or understanding that is gained through involvement in or exposure to a specific activity, event, or process.

Expectation

The standard or level of performance, behavior, or outcome that is envisioned or demanded in a particular situation based on previous experiences, knowledge, or assumptions..

Video Highlights

Please take a moment to view a brief video highlighting some of the key moments from our initial meetings with the participants.

2024 Fundraising Luncheon

The 2024 LFYO Fundraising Luncheon is just around the corner.

The Location

Hyde Park Prime Steakhouse (Downtown)

The Time

11:30 AM to 1:30 PM.

The Offering

A first-class experience at a five-star dining establishment while mixing and mingling with some of Central Ohio’s most prominent and influential people.

The Date

September 20, 2024

The Cause

To raise investment support for LFYO programs.

The Crowd

Business leaders, former Ohio State and ex-professional athletes, and philanthropic-minded individuals (like yourself) will be in attendance.

Thus far, we have 20 committed sponsors and 5 more left to secure. Might you or your company join this prestigious list? Don’t delay. If you or your company is interested in sponsoring or attending the event as an individual or couple, please email me at info@MrFundy.com. For more details on the 2024 LFYO Fundraising Luncheon, please click the link above.

In closing, we want to acknowledge our 2023 Legacy Sponsor, Maggie and Tom Fleming. Their generous contribution allowed LFYO to purchase 23 new iPads with bluetooth keyboards and protective cases. To the Flemings — and every LFYO investment supporter — thank you for helping us carve out our unique niche in changing lives and transforming legacies here in Central Ohio and beyond. Again, thank you.

LFYO Program Update – May 2024

LFYO Program Update – May 2024

• Columbus Park and Recreation – Teen Impact Program

• GoodLife Skilled Trades Program

• Elv8u Entrepreneurship Program

The State of Mental Health for America's Youth

The State of Mental Health for America's Youth

Why They're Hurting, How We Can Help Them, and Where to Start First

Don’t be troubled by the length of this article; it’s a fast read about a very troubling subject. Brevity won’t do it justice.

A lot of young people are struggling in a major way, though few care to admit it. Their upstairs and downstairs brains are skipping floors. Upstairs deals primarily with the cerebral cortex, or what occupies roughly 80 percent of the top floor brain and nearly 100 billion neurons. Downstairs refers to the gastrointestinal tract, with approximately 100 million neurons occupying the bottom floor brain. Newbie minds with topsy-turvy bellies as well as rollercoaster hearts are in a state of flux. Whether mentally, emotionally, or relationally when it comes to the wellness factor, the trend is not their friend. Not even close. Covid did exacerbate problematic distress states, but let’s be clear. Many under the age of 25 were hurting long before the pandemic hit the scene and shook us to the core. As the rise in social media addictions captured their hearts, the drop in wellbeing broke their spirits. Has this inverse relationship been a mere coincidence? I don’t think so. One thing is certain, however: Mental illness is an equal-opportunity disruptor. Doesn’t matter how much (or little) money you have, nor the pigmentation of your skin. When it hits, you feel it. Your inner and outer circles do as well. And society pays a heavy price to curb that pain. Depression. Bipolar and autism-spectrum disorders. PTSD. Anxiety and panic attacks. Compulsive behaviors. Drug and alcohol addiction. Self harm, suicidal ideation, and homicidal inclinations. Now, why would our young people be in the fight of their mental sanity lives with the whole world in front of them? I don’t claim to have all of the answers, but let’s explore some of them.

Correlation doesn’t equal causation but it should lead to contemplation.

Why are our young people hurting so much?

Lots of reasons exist, but the driving force behind (or in front of) their pain and suffering is a depleted or bloated biochemical system. Too little or too much of any feel-good neurotransmitter isn’t good for the body, brain, or belly. And the five emotional needs that play a pivotal role in balancing the biochemical ledger account (BLA) include the following: to be loved, to be heard, to be understood, to be respected, and to be seen. “To be loved” has everything to do with the oxytocin system, the body’s loving, trusting, and bonding apparatus. Love is a feeling wrapped in the customized gift of care, concern, and compassion. It’s an action word that’s impossible to express or experience without tangible proof. No verifiable evidence, no authentic love. It is the litmus test by which commitment to wellbeing is (and should be) measured. When youth and young adults don’t feel loved, they can’t outwardly express lovingkindness in the world. Unfortunately, many of them don’t even feel lovable enough to embrace genuine affection given our AI-generated world.

Next up is “to be heard.” The voice of the voiceless is yearning to be heard, not judged (although accountability is critical for proper growth). Listening is truly a lost art. Active listeners pick up on the cues and clues of the speaker, notably what is said and how it sounds. Semantics deal with what is said, while acoustics serve as the amplifying pitch or diminishing cadence behind someone’s phonetic words. Pay careful attention to a young person’s verbs, adverbs, and proverbs. A verb indicates an action, event, or state of being. What does this person need, want, or expect? An adverb modifies a verb, adjective, or adverb, or various other types of words, phrases, or clauses. Usually ending in “ly,” adverbs can often express the magnitude of a young person’s condition or outlook from a pain, pleasure, or passive perspective. A proverb is a condensed or shorten saying that conveys some important fact of experience that is taken as true by a person, group, or community. For youth still reeling from the effects of trauma, their proverb can serve as a motivating force or debilitating course in every aspect of life. It just depends on how they’re wired.

“To be understood” isn’t the same as being heard. Complements or close allies, yes, but substitutes or synonyms, no. Perhaps the biggest mistake Generation X and Baby Boomers make is superimposing their era’s customs and traditions as the de facto norm for success in 21st century America. Now, principles are timeless but practices may change. What worked then may be outdated today, especially when life was much slower in decades past. What seasoned adults do wrong is pull young people back to the good ole days instead of jump forward to greet them in these hectic, fast-paced times. Understanding is about being heard (and hopefully treated) on equal footing. This was not the case in the ’50s, ’60s, or even ’70s. Youth weren’t heard, nor understood; they deferred to their elders because that was standard protocol. Today’s young people expect sensitivity from those advanced in years, which can harmonize or balance their gyrating emotional state.

Young people are sick and tired of the disrespect. “To be respected” is what they demand from peers and progenitors in private places or public spaces. Seasoned adults have called them lazy, indifferent, and delusional. They have been told in corporate settings, “You can’t be pushed to the front of the promotion line without waiting your turn. That’s not how it works here in moving up the C-suite ladder!” Young people also feel that older generations don’t believe in them, and that passing the responsibility baton to Millennials will result in a dropped opportunity. So, they feel unfairly judged, mistreated, and maligned for their youthfulness. Of course, age discrimination works both ways. Thus, disrespect can lead to anger, disdain, or outright rejection of the principles, practices, and procedures that have defined the success path of previous generations. Not surprisingly, their mental, emotional, and relational wellbeing has taken a beaten. Unfortunately, some NextGen cohorts do fall in line and fall in love with the prophecy that has been said about them. That they play video games all day, surf the Internet for clickbait gutter stories, and party well in to the night using borrowed credit cards (while disrupting their precious circadian rhythm in the process).

If it takes a village to raise a child, then it requires a community to repair a broken soul.

Fighting for attention is the right “to be seen.” Doesn’t matter if it’s through toxic attitudes, desperate measures, or counterproductive efforts. This is a self-image play, which is usually tied to a self-preservation ploy. The result? A survival of the fittest mentality hellbent on relevancy. Earning street cred, increasing followers on social media, or accentuating a body part, piercing, or tattoo for brand identification purposes is par for the course today with our young people as well as those who refuse to grow up. Extended adolescence is not a good thing in your 30s, 40s, and 50s. You see, I’ve worked with over 30,000 youth and young adults over the past two decades. In short, here’s what I’ve observed about this demographic. Their covert or overt approval-seeking behaviors are easy to spot, with validation expressions being the prized possessions to hide their deficits. I speak from personal experience, and they’re incredibly difficult to break free from when hangups, holdups, and hiccups are trauma based. On the nonprofit side, I’m usually asked to work with and fix broken souls. Think Kia Boys. Paternal abandonment and testosterone surges during puberty that fuel their desire to pursue novelty-seeking thrill rides with little (to no) regard for consequences are driving their behaviors. In general, Kia Boys come from fatherless homes, aren’t involved in organized sports (and miss out on surrogate, father-figure coaching), and could care less about academic achievements. On the for-profit side, I work with companies in a variety of areas, notably group collaboration, leadership development, and DE&I offerings. In most cases, how colleagues are viewed and valued play the biggest role in how they perform in a solo or team-based setting. Doesn’t matter their position, age, race, gender, or sexual orientation. Remember my reference to oxytocin a bit earlier? Receptors for this neuropeptide are found in the eyes, among other places throughout the body. And whatever we give our continual gaze to we typically bond with or find value in. So don’t be stingy with your eyeball hugs of affirmation, appreciation, and acceleration, the AAA boost that can prevent our young people from needing roadside assistance. Got it?

How can we help young people get ahead in our fall behind world?

If you’re a seasoned adult, alright, over the age of 40, don’t take this too personal. But youthful souls with inquisitive minds are wondering, “Will the real adults please stand up because the cardboard cutouts in the corner don’t count.” They’re confused. They see the outlines of people in grownup bodies acting in childish, really cartoonish, ways. No need for Tom and Jerry reruns with our current cast of adult caricatures. Our political scene is polarizing (and sure to get much worse as election season rolls and roles around later this year). Our sociopolitical system can’t agree on the definition of “fairness for all,” especially when the privileged few call the shots. Our geopolitical situation is a hot mess, home and abroad. What’s left just might be the right thing for young people to do. Sit on the sidelines as the apolitical majority. What choice(s) are we leaving them to make? Here’s how we help our young people, and it isn’t rocket science but common sense. Be the example before we ask them to follow it. Practice what we preach. Walk the talk. Nothing more, nothing less. And this has everything to do with a profound sense of purpose, which is highlighted next.

Where do we start first in our advocacy of NextGen’s mental wellness?

Where we start first in helping our young people should lead to the end of the matter — a purpose-centered existence. Purposeful people don’t have time for childish, blaming-framing-shaming games. Too much is on the line to get distracted by such foolishness. When youth and young adults understand the essence of purpose (with an emphasis on personal branding as the intro), every aspect of their lives can change for the better. But when their purpose is unclaimed, they’re shortchanged by life. And when purpose is unanswered, they will shortchange others throughout life. Productivity and conductivity are two residual benefits of purpose-led individuals. They’re more efficient and effective in connecting with others. Guess what other benefits are in store? A sense of purpose has a profound impact on mood and overall wellbeing. Young people will sleep better. They will cope smarter. They’ll live longer (People Who Feel They Have A Purpose In Life Live Longer, NPR, Patti Neighmond). And a life assignment can provide them with a natural high that weed –– or any drug or drink for that matter –– can never top. In fact, they likely won’t have a taste for that puff puff or pop pop (as in pills) anymore given their newfound state of bliss. Check this out: a life without purpose is an existence devoid of meaning. Sounds harsh, I know. Here’s my definition of purpose:

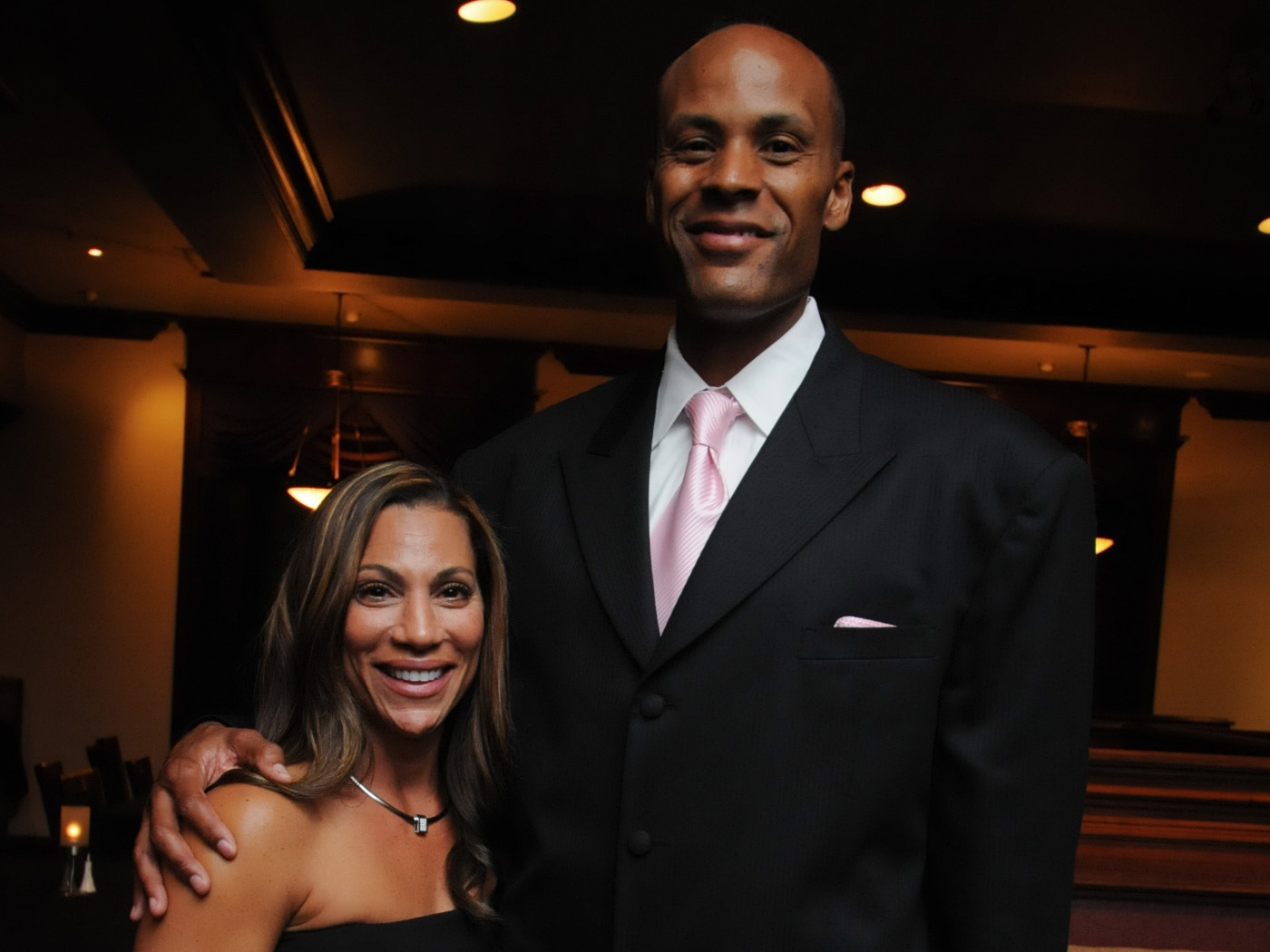

In closing, an investment secured will satisfy a payment made, but a payment made is not equal to an investment secured. Payments are tied to accumulated debts, while targeted investments can produce lucrative returns. Yes, ROI. As my good friend, an entrepreneur and PGA tour golfing coach, Jerry Hammond Jr. likes to say, “We need to be counted on and accounted for.” So much is riding on our ability to prioritize the mental health of younger generations. We can pay now, so they can play later. Or we can play now, but they’ll pay later. And when we see a need but don’t fulfill it, a lot of innocent people get hurt in the process. Let’s do our part in giving an assist to the next generation. Why? Because our legacy is attached to theirs. Lastly, I’ll be the featured speaker at Sow Plated’s Live Sow Well Speakers Series this Monday, May 20th, in conjunction with Mental Health Awareness Month. Located in Upper Arlington, this is our (my wife Monya and I) favorite restaurant in Central Ohio. Seating is limited; click the link to secure your spot. Bon appetit to great mental health!

Why Mental Health is Such a Big Deal Today

Why Mental Health Is Such a Big Deal Today

May is Mental Health Awareness Month, a time we can reflect on our own (or a loved one’s) struggles in this area. Last year I wrote about my mother, Laura Funderburke, aka Ma Dukes, and her decades-long battle with compulsive disorder, schizophrenia, and agoraphobia (or the anxiety of being in crowded places). And she also suffered from a laundry list of fears, insecurities, and trauma wounds too numerous to mention. As a self-proclaimed Momma’s Boy, I miss her deeply. Ma Dukes passed on February 8, 2021. Due to Covid lockdowns at the nursing home, I couldn’t hug the woman who brought me into this world before her untimely death. I could only communicate with her by cell phone while standing outside, piercing through the window on that brutally cold day. A mother’s touch is one of the most special and sacred blessings this hurtful world has to offer. If you’re mother is still living, please hug her for me.

Mental health is such a big deal today for several reasons. First, many of us were struggling long before the pandemic hit in March 2020, hiding behind the facade that all is well in the “upstairs brain.” Like Ma Dukes during my childhood, she tried to put her best foot forward in the land of economic heartache. But her smiles of deflection couldn’t cover up the pain of a single mother worrying how she’d take of four kids on a solo-parent mission, even with monthly government assistance. Second, and this is controversial, but those toxic thoughts in the upstairs brain eventually make their way to the “downstairs brain” — the gut. Known as the second brain, the gastrointestinal tract is the dumping ground for our food, what we eat and unfortunately, what eats us. Worrisome or intrusive thoughts, painful flashbacks, and fits of rage don’t just flutter around in the ether of our subconscious mind. No, they are eventually digested, absorbed, and utilized by the body as anti-nutrients when macro- and micronutrients are lacking. (Macronutrients include healthy fats, carbs, and proteins. Micronutrients consist of vitamins, minerals, antioxidants, flavonoids, and polyphenols, among others.) Third, a life devoid of purpose with runaway stressors in ample supply can be a debilitating and seemingly never-ending condition. As the Geto Boys rapped back in the day, “My mind is playing tricks on me.” Without a mission-guided existence, the human spirit will decay from within. Purposeful people are keenly aware of the need to feed their body, soul, and spirit with beneficial nutrients, of the edible and indelible kind.

The mental anguish was so intense for my mom that she threw in the proverbial towel, merely existing in life as her spirit faded away by the day.

Allow me to put on my Dr. Phil hat to feel what needed to be filled in my mom’s life (and I suspect others’ lives as well). Ma Dukes suffered from the trifecta, mental illnesses, mental issues, and mental islands. Not surprisingly, I picked up some of them. I define mental illness as a clinical diagnosis that describes psychological, (bio)chemical, and/or emotional imbalances in the brain, the belly, and the body. Mental illnesses can, and usually do, inhibit a person’s ability to function in life. Depression, panic attacks, post traumatic stress disorder or PTSD, and bipolar, to name just a few, can disrupt work schedules and working relationships with family members as well as friends. Ma Dukes was terrified by “the voices in her head.” At night, partial light served as her security blanket while sleeping, which obviously disrupted her circadian rhythm the next day (and can contribute to a host of mental health challenges when the body’s internal clock is out of sync). Also, she would wash her hands for hours with abrasive substances, such as bleach, Pine Sol, and laundry detergent. To clean what? Lord only knows, but it likely had something to do with that mental stronghold or cognitive ritual to guard against “an extreme fear of being contaminated by germs” (Healthline, OCD: When Cleaning is a Compulsion). Three people close to my mother had died within a year of each other, two by cancer, which kickstarted her compulsive hand-cleaning behaviors in the early 1980s.

A mental issue is an odd, quirky, or dysfunctional behavior that is largely driven by internal or external triggers. Mental issues can but they do not necessarily inhibit an individual’s ability to function in life. Ma Dukes didn’t shake hands, nor did she like being in crowded spaces or public places. I don’t like to shake hands, nor do I touch door handles, elevator buttons, and other “germ-ridden” things without a paper towel. I’ve been this way for decades, long before Covid hit the scene. I guess the apple doesn’t fall too far from the tree, which may explain why mental health challenges have both a genetic and an epigenetic (or environmental) component. What we see, we often imitate — good, bad, or indifferent. It’s been said that genetics load the gun but epigenetics pull the trigger, or the nature-nurture dynamics at play, in my case, operating in reverse order. Quirky behaviors that deviate from the norm while garnering a few strange eyebrows from onlookers will have you/me/us being thrown in the oddball category at best or the weirdo basket by default. Being a 6’9” skyscraper doesn’t help my case when a room full of people see me dap an esteemed dignitary instead of extending the classy and customary, gentlemen’s handshake. As Jim Jackson, the former Buckeye basketball legend and current sports analyst likes to say, “That’s Lawrence for you; he’s a different dude!” That I am, but is it by choice or force?

Mental island is perhaps the hardest for me to discuss parentally and personally. I define it as an imaginative place of refuge in which an individual escapes to find comfort, protection, or isolation from people, places, or predicaments. Why? Because the pain — or the lingering fallout from the Covid crisis by individuals still gripped by fear — is too unbearable to deal with. Mental islands may or may not inhibit a person’s ability to function in life. It all depends on his or her daily tasks, responsibilities, and obligations. As highlighted, Ma Dukes suffered from agoraphobia. As a welfare recipient, she didn’t work. In fact, she never had a job. Her cocoon was the sanctuary of our apartment in Central Ohio’s most dangerous housing project, Sullivant Gardens. Ironically, the roots and offshoots of her trauma and mine were planted in the ghetto. During my high school years, she kept the curtains closed. Natural sunlight was painful for her, which likely meant that her Vitamin D and serotonin levels were low. Without this super nutrient and feel-good neurotransmitter in adequate (but not excessive) supply, people are more prone to depression and a compromised immune system, among other punishing conditions. Ma Dukes was terrified to leave the apartment and watch me play sports. She’d ask when I would walk through the door after a high school basketball game as one of the country’s top-five players, “How did you play son?” I responded disrespectfully, “I guess you’ll have to watch the news to see my highlights.” I didn’t even look at her as I walked upstairs to my bedroom. I was hurt by her lack of support; she was suffering from mental distress.

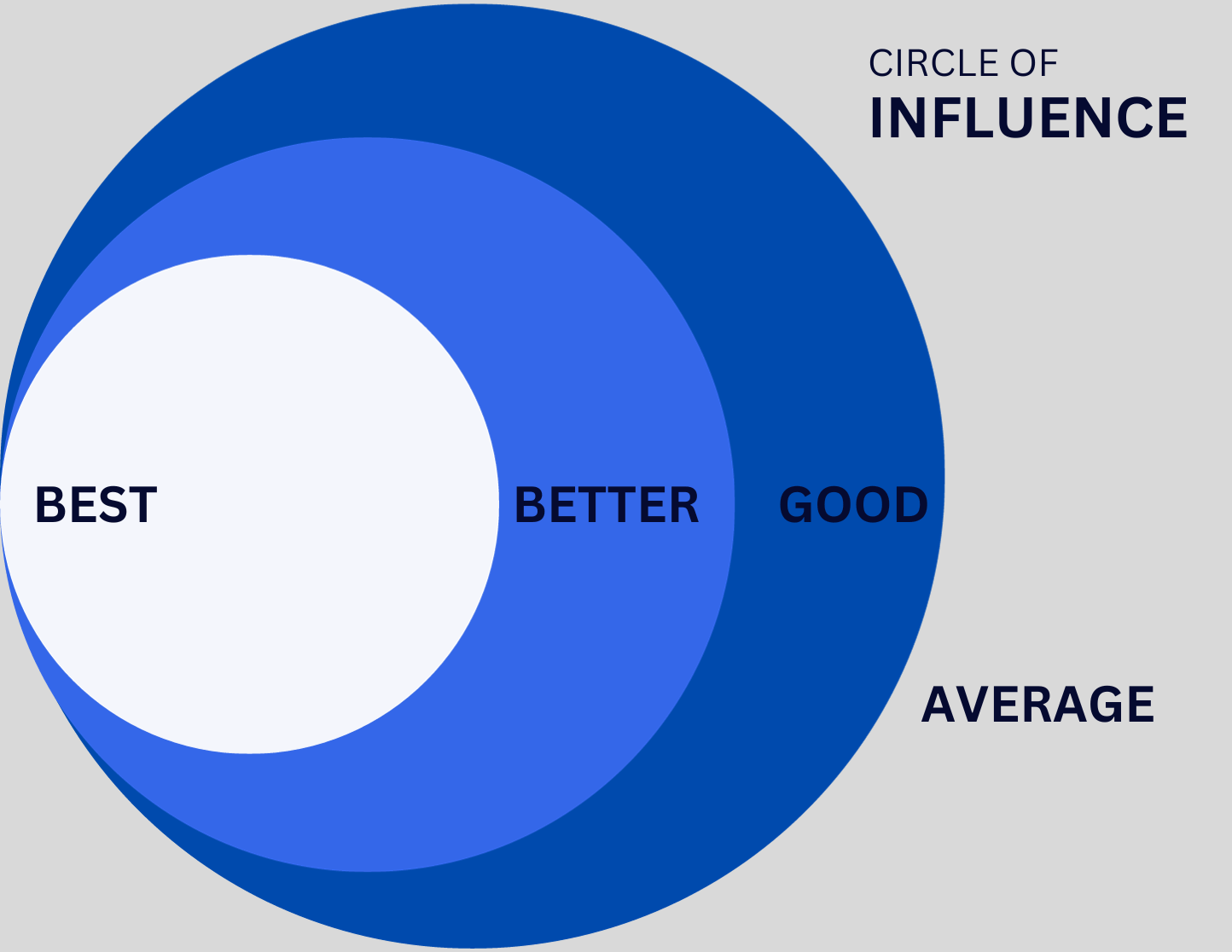

In closing, mental health has to be our pressing concern. And we can’t focus on its importance one month out of the year. Mother’s Day is just around the corner as well as my mom’s birth date, May 30. Do me (and yourself) a favor. For the next 30 days, track your mental health status. Implement a holistic game plan to improve your mental, emotional, and spiritual wellbeing. Prioritize exercise and nutrition; move your body and eat better, aka the medicine foods of God. Pay careful attention to your circadian rhythm or body’s internal clock. Even if you don’t have a 9-to-5 job, you still need a daily schedule. Life was meant to be purposeful and productive. Assess your relationships from a good, better, and best fruitful tree. Those that fall outside of these three root-system categories might need to be pruned or severed. Where applicable, make an appointment to see a qualified healthcare practitioner to assist you in your road to recovery.

Lastly, I’ll be the featured speaker at Sōw Plated’s Live Sōw Well Speaker Series on May 20th in conjunction with Mental Health Awareness Month. Located in Upper Arlington, this is my favorite restaurant in Central Ohio. Seating is limited, click the link to secure your spot. Bon appetit to great mental health!

The Era of Civil Rights and Beyond

The Era of Civil Rights and Beyond: What Have We Really Learned?

If you’re a non-Hispanic white, don’t get nervous. This article will not be a blame white America hit-piece. However, you’re certainly not off the hook. And if you’re a person of color (POC), you have a lot of work to do as well. As POCs, the role you and I play in bridging the racial divide will be just as significant as those in the majority group. Many whites, especially those with a conservative political bent, are uncomfortable revisiting a painful time in our nation’s blood-stained history. Slavery. Jim Crow. Civil rights. To them, going back does not equal forward progress. Valid point. But we must go back there so that freedom can be achieved right here — today in the opportunity diversity arena. Check this out. A lot of American blacks with ancestral ties to slavery still see themselves as foreigners in a land of limited opportunities. It’s hard to explain but quite easy to feel. That nagging sense to disconnect from any form of patriotic expression while reflecting on “the life, liberty, and pursuit of happiness” promise by our Founding Fathers. It seems that someone, something, or somewhere will remind us to get back in line when we step out of place. An insensitive comment (like the one I hear all the time, “Wow, I would have never guessed that you are a CFP.”) A distancing observation (such as this common phrase, “I don’t see color.”) An incredulous stare-down (along the lines of, “How did you people hear about this exclusive vacation spot?”) Covert racism is more insidious than the exploits of overt racists. As a black or brown individual, you’re often left holding the interpretation bag when an underhanded comment, off-the-wall observation, or judgmental stare-down misses the racial sensitivity mark. In 2024, this shouldn’t happen. Then again, it’s not that surprising.

When you see a need and don’t fulfill it, a lot of innocent people get hurt in the process.

It’s not what we, seasoned adults, have learned, those of us born between 1940 and 1980. But what our children and grandchildren have not learned — notably the integration of an opportunity diversity playbook to assist black and brown Americans on the fringes of society. Our two kids, Nyah and Eli, would often accompany Monya and I when our nonprofit organization offered empowerment programs to inner-city youth more than a decade ago. Though a minority, they witnessed firsthand how privileged their life was compared to other melanated children. Opportunity gets you to the door (which can be the result of color preference). Diversity of talent, work ethic, and competency keep it open. If we’re honest, two worlds exist in our black community. Those who have taken advantage of opportunities, a small minority. This group is often accepted, and in some cases, revered in mainstream society; they’ve been able to maximize and monetize a given skillset or engrained mindset. The other world? Those who are taken advantaged of by opportunists (which include gang-bangers, drug dealers, and “unity” peddlers who promote a common bond but cause internal rifts). This growing segment of the black population has struggled in finding and funding their value proposition in life, which has become an exhausting ordeal. Unfortunately, far too many of them just give up and live for the moment.

Nyah Funderburke is my oldest child. A college junior and communication’s major at Ohio State, she is blazing her own trail in the classroom and swimming pool as a dean’s list student, All Big Ten performer, and NCAA All-American swimmer. While fair complected, Nyah often blends in with her white teammates in the pool. Out of 75 male and female swimmers, she’s the only African American on the team. Very few black and brown swimmers compete at an elite level. Those who do, stand out. In high school, she shared this startling revelation with me. She said, “Daddy, my focus is to swim in lanes 4 or 5. When swimming in these lanes, the best lanes, you can impose your will on the other swimmers since the waves are pushed from the inside-out.” Fascinated, I asked, “What do you mean?” Nyah responded, “Those on the outside lanes, 1 and 8, have the toughest time. They’re in the worst swim lanes and must contend with the waves coming from the middle lanes and off the wall ….” I interrupted, “Wait, you can still win — your room for error is incredibly small, though.” She chimed in, “That’s right Daddy, just like the people you and Mommy help through LFYO. They may not see the waves, but eventually they’ll get so tired fighting against them.” Hmmm, the waves of injustice. Her assessment at sixteen was refreshing. Same pool, different race. Life outcomes (and swim results) will largely depend on a person’s lane assignment. Today, Nyah’s vantage point on race in America has broaden as a young adult. Last summer’s visit to Selma, Alabama, to march alongside other black and brown Big Ten athletes on the Edmund Pettus Bridge transformed her thinking on opportunity justice. Click the link below to watch Nyah’s Big Ten Network feature, which aired on February 9th. You can visit her website at www.NyahFunderburke.com.

The Influencer in You - 5 Part Series #5

The Influencer in You: Why Mentoring Works, How It Changes Lives, and Where It Transforms Legacies

Series #5: The Change

Bankable Change: It’s How You Measure Your Mentoring Worth

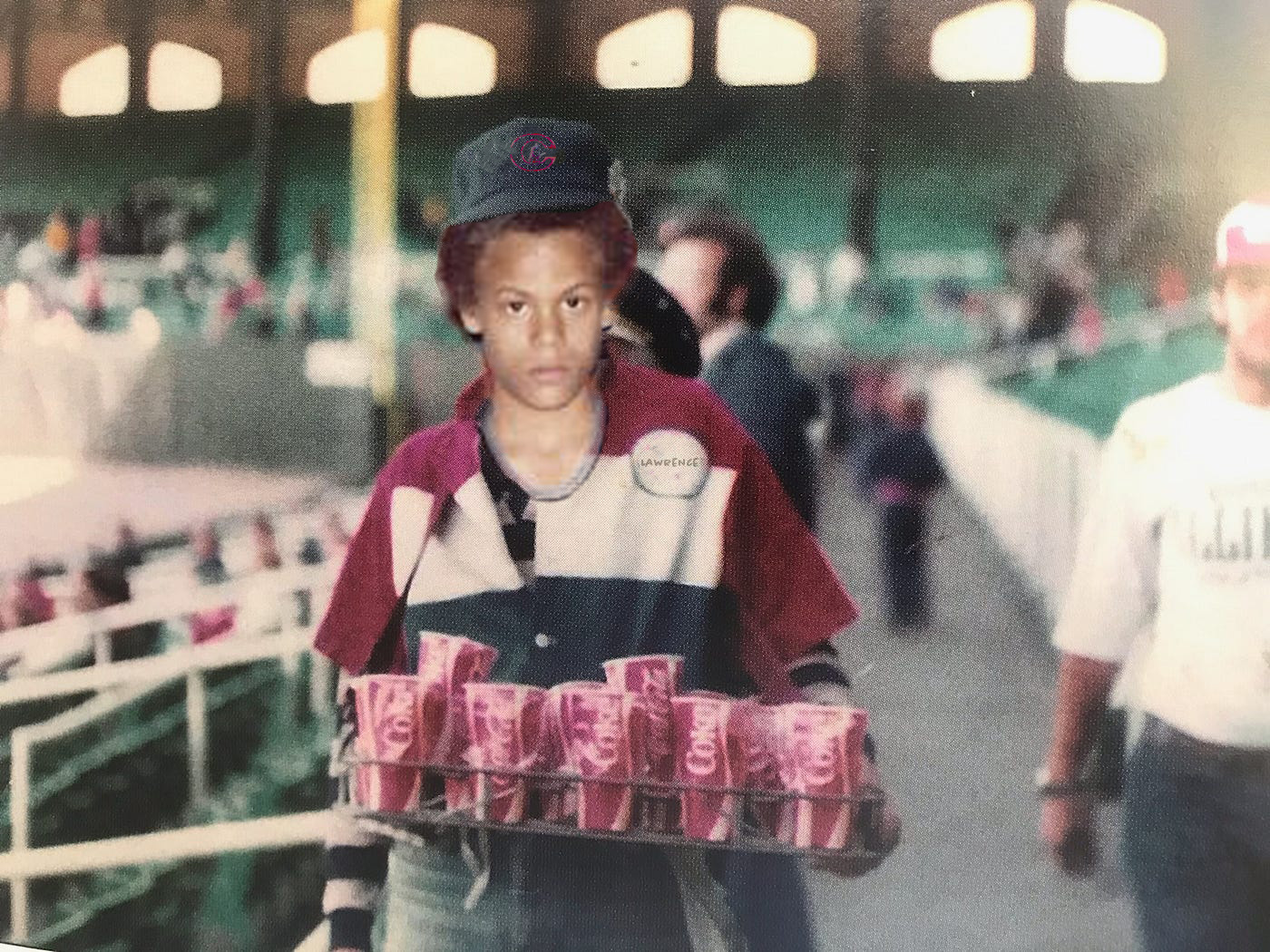

Let’s talk change, the litmus test of mentoring success. I loved hearing customers who just bought my last watered-down Coke as a teenage vendor at Cooper Stadium and the horseshoe blurt out, “Keep the change!” It was music to my ears. Another beverage rack had been sold, with a much-needed tip earned by a poor kid from the Bottoms (or lower westside of Columbus) growing up in the Sullivant Gardens Housing Projects. Each rack sold netted me 10 percent of sales or $2.00. A paltry sum back then, but every dollar counted. As a welfare recipient and math aficionado who could make change with the best of them, I had a pretty good idea how much money (and likely tips) I’d make at Columbus Clippers baseball and OSU football games. You see, I got my hustle on — legit. I sold cokes, hotdogs, Cracker Jacks, popcorn, peanuts, and even San Diego Chicken programs. Rain or shine, I hustled. I had people to meet, places to go, and predicaments to overcome. I was the black version of Huckleberry Finn, so named by my mother, “Ma Dukes.” A lot of my neighborhood peers chose the drug-selling route. I knew better and would feel much worse if Ma Dukes, a 6’0” black woman with huge hands and a formidable grip, ever caught me making an illegal buck on the streets. “Boy, I’ll slap you into next week if I catch you …” Those bone-chilling words still reverberate decades later. Ma Dukes meant what she said and would make good on every substantive threat. Peep this. Bad grammar I know, but “scared money don’t make money.” And fast money never produces meaningful change; it usually makes things worse. Humbly speaking, making change is quite easy for me. I don’t set New Year’s resolutions. I don’t struggle with doubt (but I’m not immune from insecurities). I don’t wait to make a difference; I see needs and fulfill them without being asked. Making change as an invested mentor or ROI mentee won’t be hard for you either. That is, if you develop the right mindset and count the ongoing costs upfront. Right now.

Did you know that only 9 percent of New Year’s resolutions are actually achieved? In other words, 91 percent of people fail in the completion of their New Year’s resolutions, with January 17th serving as “Quitters Day.”

A Mentoring Assignment Too Close for Comfort

Eric Seabrook has been a mentor of mine for years. An attorney by trade and a life coach by tread, Seabrook has decades of experience as a tireless counselor. Early in the mentoring relationship, he did what any seasoned mentor should do to propel a mentee’s growth trajectory. He asked me a loaded question that was prepackaged as a gut-punch command. As an O+ blood type, I have pretty thick skin. O blood types, + or -, tend to be carnivores (and thus have higher levels of stomach acid), usually need intense exercise to burn off steam, and are generally not afraid to “tell it like it is.” Don’t shoot the messenger; I’m merely highlighting a few key points outlined in the best-selling book, Eat for Your Blood Type. As we were wrapping up our conversation, Seabrook pointed out, “Wouldn’t it be tragic for you to assist inner-city communities in achieving better life prospects and not help your own wife reach her full potential?” Silence. With a scowl on my face, I gave him that look of disbelief: “You calling me out, bro?!” Yes he was, and I deserved it. “I didn’t know if you would punch me or walk away from our friendship, but I had to bring this to your attention,” he added. My wife Monya is a beautiful black woman with immense talents as a graphic (and website) designer, certified wellness coach, and culinary star. Seabrook’s mentoring call out to me was really my wife’s call up. Unlike me, Monya’s more comfortable with behind-the-scenes roles. But without her potential and purpose being unlocked, mine would be on lockdown. The two shall become one. Don’t get hung up on the words “mentor” or “mentee” if you’re married. Embrace reciprocal learning. A great teacher must also be a sponge-like student. Please keep in mind: Mentoring is about influence, and influence has everything to do with change. Make an impact on the home-front (or within your extended family circle) before you look to make a difference at work or in the community. It’s not worth losing the soul of your spouse or child(ren) for the sake of public recognition. Insiders know the real you; outsiders don’t!

Mentee in Training: A Look at One of My Most Embarrassing Moments

Rookie status in pro sports, or the business world, can lead to several first-year blunders. After the NBA, I worked briefly at John Sestina and Company. The owner, John Sestina (who has since sold the company) is considered the godfather of fee-only financial planning, a compensatory structure involving a flat fee or yearly expense that’s charged to clients for financial advice. Those eight months being mentored by Sestina, Tyler Cook, and Stephen Lukan in 2008 were difficult. The learning curve for comprehensive financial planning, on the advisor side, was quite steep for me. And the test to become a certified financial planner (CFP) was even more mentally draining than playing in the NBA. My workspace was right next to Cook’s, a former colleague and mentor more than a decade younger than me. He was patient, persistent, and prescient in his mentoring duties. I asked one dumb question after another, which didn’t faze Cook. In terms of persistence, he challenged me to see financial planning from the eyes of my former profession. Assist clients on offense by helping them save money and build assets, with defense being tied to insurance and tax planning strategies. Watch out for spending turnovers, which are most often found under the basket of variable expenses. Rebound (or recover from) missed financial shots or unforeseen setbacks — a divorce, illness, or job loss. Cook’s prescience showed up when explaining estate planning concepts that were foreign, at the time, to my way of thinking. I reiterated in one of our mentoring sessions, “You’re talking about an executioner, right?” He couldn’t stop laughing and remarked, “I knew you’d say that word instead of executor.” He continued, “An executioner is someone who kills another person, but an executor carries out the wishes of a decedent’s estate as specified in a last testament or will. I guess death is the common link between these two words.” Cook, Lukan, and Sestina taught me how to laugh at myself when making embarrassing mistakes. Mentors and mentees, take the responsibility seriously but not yourself. Laughter does the body good.

The Power of Philanthropy Is the Gift of Presence

In closing, the good book tells us, “It’s better to give than to receive.” In a world where presence is needed more than presents, change agents must be well-versed in their gift-giving efforts. Yes, meaningfully and materially involved; substance always matters. Whenever I present our Mr. Fundy’s Mentoring Playbook for Youth and Young Adults to groups, I’ll hand an audience member from an at-risk background a $20 or $50 bill and say, “Keep the change.” As Frugal Funderburke, a self-proclaimed cheapskate, I don’t like spending money. But as a life coach and non-traditional educator, the money lost is a down payment on a future investment gained. In the lives and legacies of vulnerable populations who must understand that intangible wealth, of the intellectual kind, always precedes tangible income. “Develop the skills now to pay the bills later” is their lightbulb moment. The benchmark of self-worth (and net worth) is the balance sheet, not the income statement. Strengths are assets, and assets are the things you own. Financial assets include bank accounts, stocks, and material possessions, such as cars, clothes, and computers. But internal assets are the things mentors and mentees can leverage to produce two-way change. They encompass trust, honesty, discipline, hard work, and teamwork, among many other noteworthy attributes. Struggles are liabilities, and liabilities are the things that own you. Financial liabilities consist of debts, loans, or monetary obligations that must be paid (usually with interest) at some point in the future. Internal struggles include toxic thinking, disrespectful attitudes, poor work habits, low self-esteem, and lack of purpose, and so forth. It’s not a capability issue with high-need populations; it’s an accessibility problem. The formula to close the great divide in America is simple: Social Justice = Racial Equity = Opportunity Diversity. Nothing changes externally — socially, racially, or opportunistically — until we transform internally. It’s time for mentors to step forward so that the least among us can step into their mentee greatness, one influence game plan at a time. Are you doing your part?

"Tough" Questions to Consider:

Where do you need to step up in your mentoring playbook or influence game plan with those (inside or outside the workplace) who don’t look, think, or act like you? When will you get started?

How will you make a difference personally, professionally, and philanthropically with your internal assets? What metrics will you use to gauge your effectiveness in terms of baselines and benchmarks?

Which of your internal struggles trips you up in not being a more effective mentor, mentee, or mentoring proponent? Why is this particular struggle holding you back or hindering your growth?

Interested in Learning More?

Click the button below to learn more about my mentoring initiative and other empowerment offerings to assist you or your organization.

Related Articles

The Influencer in You - 5 Part Series #4

The Influencer in You: Why Mentoring Works, How It Changes Lives, and Where It Transforms Legacies

Series #4: The Synergy

The Musical Chord of Mentorship Frequency

You’ve probably given little thought to the biochemical underpinnings that shape mentoring relationships. One thing is certain about great (or even good) ones: the synergy or harmony is so powerful, actually electrifying, when two or more people work together for a common cause. Enter the oxytocin zone. What is oxytocin? It’s a neuropeptide that plays a vital role in breastfeeding for nursing mothers and bonding for loving caregivers. It’s also what drives organizational success, whether it’s corporate America, a sports team, school district, household, or mentoring engagement. No connection, no collaboration. No collaboration, no cooperation. No cooperation, no (effective) communication. Just a lot of background noise that drives people apart instead of the symphony of bringing them together. Remember my emphasis of good, better, and best mentors in the second and third articles of this influence series? What’s good can be better, and what’s better has to be the best. Through culture, the best companies treat their colleagues, customers, and community partners like family. Through teamwork, the best sports teams are always on the same page, playbook, and pulse. Through excellence, the best school districts prioritize and harmonize this commitment to greatness 365 days a year in their interactions with staff, students, and stabilizers (or caregivers). Through love, the best households are sacrificial in their bonding, banding, and binding efforts with other family members. Remember the sitcom, The Partridge Family? Yes, I am dating myself. Through frequency, the best mentoring relationships leverage that special frequently — each manageable, memorable, and marketable engagement moment. And you can’t build mentoring momentum without it!

The frequency of connectivity is rooted in diversity, or the mentor’s ability to assist mentees personally, professionally, and philanthropically.

Let’s dig deeper into the neuroscience of rhythmic frequency, a misunderstood area of brain anatomy that spooks some people because of the terminology used to describe magnetic connections. Music and mentoring are both universal. And they feed off of that miraculous oxytocin spark that serves as the catalyst for a win-win relationship, well-respected leadership, or rock-solid partnership. Mentees resonate with mentors of trust. Employees resonate with trusted leaders. Spouses resonate with trustworthy life partners. In every case, the frequency or vibrancy of a harmonious connection is key. Speaking of being on key, Mark Lomax is a talented musician. He’s also a father, husband, composer, educator, lecturer, author, activist, thought leader, and philanthropy facilitator at The Columbus Foundation. His diverse skillset reminds me of Damon Wayan’s portrayal of a Jamaican man from the popular 1990s show, In Living Color. With a noticeable Caribbean accent, Wayan’s character in the skit would blurt out (to family members) when returning home from one job and quickly changing into another work uniform before exiting, “Hey mon, I’ve got ten jobs.” Like many actors and artists, Lomax has a unique take on things. He shared, “Mentors must strike an emotional chord with their mentees. Without it, their relational connection will be out of tune.” So true.

In our conversation on biochemistry, Lomax and I discussed the therapeutic benefits of mentorship and music, notably mood regulation. The best mentors are able to influence the mind of mentees through the mood of frequencies. Hype has a frequency. Hope has a frequency. Help has a frequency. Dial in to that station to move your mentee through each phase of the mentoring connection cycle. On the home-front. At the workplace. In the community. The first order of business for the mentor? Get the mentee fired up about a potential mentoring arrangement (or stay the course once it begins). This is the motivational or introductory phase where either side can back out. This stage can also be viewed as the recruitment pitch. Feelings often dominant in this phase, which is why expectations should, at some point, be highlighted prior to the official start of an engagement. Next up is the inspirational or projection phase. Here, the growth forecast is specified, values and beliefs are clarified, and personal brand statements solidified as choice muscles get exercised. Where a mentee aspires to go (in a life, legacy, or leadership pursuit) will largely depend on the visionary brilliance of the mentor to paint a compelling picture that keeps hope alive. Without hope, a mentee’s faith-led goal, driving ambition, or purposeful existence cannot survive, let alone thrive. The third phase is where tremendous growth gains occur through targeted, transformational improvements. This journey may take months, years, or decades to complete. It all depends on the investment. No ongoing payment, no lasting change. And the costs associated with change will likely exceed what each mentor and mentee have budgeted ahead of time.

Mentorship is music frequency. Hard to describe, easy to feel. The hard part is finding the right words to explain how the mentee and mentor were both impacted by their relationship. Of course, the easy part is recounting or reliving the experience in salient details. Yes, feelings fade over time, but a meaningful connection never does. Even when the engagement ends (and most mentoring relationships do at some point), those memories live on. Think about your favorite teacher in childhood or young adulthood. What do you remember about this educator’s most noteworthy talent, skill, or gift? How did this person motivate or inspire you? Why was this teacher, tutor, instructor, professor, or coach your favorite? Your reason(ing) and reaction are likely tied to oxytocin. What made learning so easy in that class? The ability to explain complicated subjects in simple terms to you and your classmates. Why wasn’t giving up an option? Those words of encouragement when you bombed a test. Where did that sense of resiliency come from? That game-winning touchdown when you’re number was surprisingly called to carry the football against a high school rival. What made a small or significant difference in who you are today? The teacher, professor, coach, caregiver, or boss who believed in you, even when your self-confidence missed the mark. Thank oxytocin for that special push, pull, or propel across the success finish line. In fact, you can’t bond, trust, or love anyone or anything without this neuropeptide in ample supply. It allows us to connect with and protect others (or hate that team up north and their obnoxious fans). One last point: Oxytocin even plays a pivotal role in our self-preservation instincts. Have you or someone ever said, “I trust no one but myself”?

Before closing out this article, I want to give a special shout-out once again to three of my mentors, Donna James, Clark Kellogg, and Steven Davis. Consulting expert and board member of several Fortune 500 companies, James’ voice of comfort as a distinguished woman of color has had a huge impact in how I present myself in corporate settings. She once shared with me, “The hard parts of diversity continue to divide us. But separation can turn into cooperation when we correctly respond to gender, racial, and religious differences.” Right on point. Kellogg, a former Ohio State basketball player and NBA star, and current CBS sports analyst, has been a relatable, reliable, and reputable mentor of mine for nearly 20 years. At our 2023 nonprofit fundraising luncheon, he pulled me aside for a Special K download. He said, “What you are doing in the lives of these young men will change the trajectory of their offspring — forever. Keep giving assists to our black and brown males, Fundy!” Say no more. Davis, former CEO of Bob Evans, will always have a cherished place in my heart. I’ll never forget his timely wisdom on adding value in the marketplace shortly before his passing. He highlighted, “The lack of colorism is an unfortunate problem at the C-Suite level in corporate America, but green settles the score. And when a POC helps a company make a lot of money, skin tone becomes less of an issue but more of a hiring priority.” Amen and rest in peace my brother. Trust. Trusted. Trustworthy. Without these qualities, the frequency of any mentoring connection gets lost in translation.

Questions to Consider:

How do you build trust as a relatable, reliable, and reputable mentor? Be descriptive.

What areas of bonding, trusting, and loving others do you need to replicate or reciprocate? Be honest.

Which aspect(s) of the mentoring connection cycle do you find the easiest and hardest to facilitate, the hype, the hope, or the help? Why?

Interested in Learning More?

Click the button below to learn more about my mentoring initiative and other empowerment offerings to assist you or your organization.

Related Articles

The Influencer in You - 5 Part Series #3

The Influencer in You: Why Mentoring Works, How It Changes Lives, and Where It Transforms Legacies

Series #3: The Investment

Wait, Count the Costs Before You (or Your Organization) Embarks on a Mentorship Journey

Why do some mentoring initiatives fail? A multitude of reasons exist, but three underlying themes eventually come to the surface when a mentorship program misses the impact mark. First up, a lack of clearly defined expectations were likely assumed but not mutually or corporately agreed upon. This translates into porous boundaries, moving targets, and/or one-sided, hit-or-miss commitments. Mentoring engagements should be free-flowing, but guidelines and guardrails should serve as the turnoff spigot when a mentee (or even mentor) violates mentorship decorum. Here’s a true story to highlight a few etiquette breaches by a mentee who turned heartstrings into bankrolled dollars. An affluent woman, Irene, mentored a single-parent mother of seven. The single-parent mom, Sheila, has had a rough life. Drug addiction. Homelessness. Poverty. All at once. Several years ago, Irene volunteered at a nonprofit organization in a less desirable part of a big city. She was paired with Sheila, and the two bonded rather quickly. Irene provided her home number (a big no-no!) to Sheila. Well, Irene found herself taking calls from her mentee on the weekends and doling out lots of cash (really, cashiers checks) as the sob stories poured in. The violin music that struck a monetary chord? Bailing out Sheila’s boyfriend from jail. Paying three months of back rent to prevent an eviction. Buying groceries at the beginning of the month for Sheila’s children, days after her welfare check had been cashed. The mentoring engagement ended when Sheila unexpectedly showed up at Irene’s home in a prestigious neighborhood and stated, “I was in the area and thought I’d stop by to see you. Can I come in and check out your home?” Irene shared with me, “I was horrified, and I felt utterly violated.” She added, “The experience left such a bad taste in my mouth; I won’t ever do that again.” That is, sign up as a compassionate, in-person mentor for those on the fringes of society. Without being briefed on how to assist the poor, arm’s-length transactions, or writing big checks to various nonprofit organizations, is Irene’s preferred option moving forward. (I did present Irene with a copy of my book, Sociopsychonomics, to help her understand the mindset of the entrenched poor and social classes in general. Time will tell if she takes my suggestions to heart on how best to empower vulnerable populations through targeted, face-to-face interactions with clearly defined expectations, well-marked boundaries, and growth-oriented benchmarks.)

When so-called, challenging growth goals are nothing more than cleverly disguised activities, both the mentee and mentor are shortchanged.

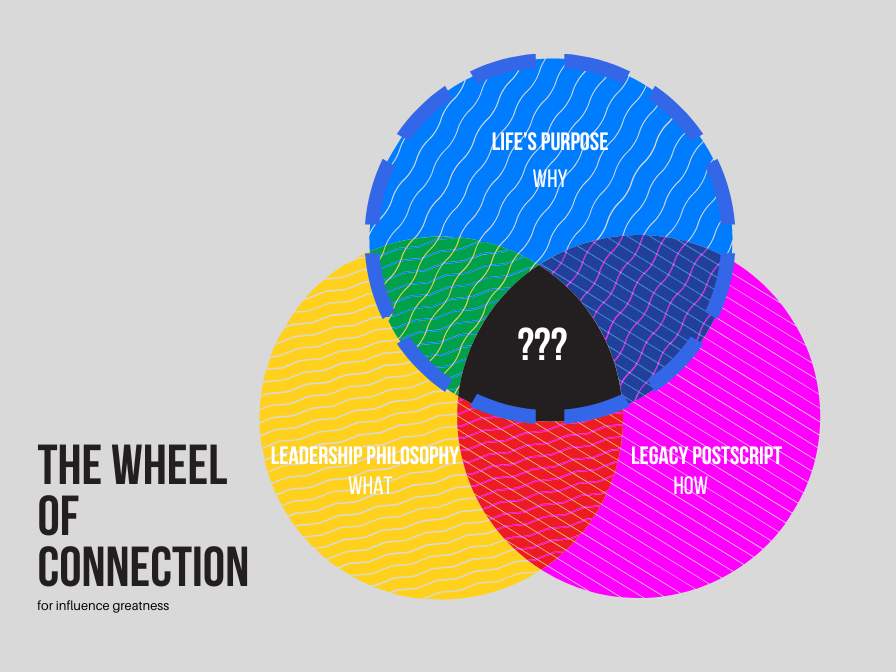

Moving targets and hit-or-miss commitments can be viewed as separate but connected factors on why some mentoring engagements fall short. In professional and philanthropic mentoring circles, flexibility can start off as a good thing and quickly turn to a bad thing. Schedules inevitably change, but frequent rescheduling can cause either side to lose heart. Remember: For some mentees, their distrust meter will rise precipitously when a mentor postpones another meeting. The guilty mentor — whatever the reason — is in danger of being placed in the mentee’s dumpster of mistrust. Warranted or not, these mentees feel that their mentors did them dirty. Another person of trust has missed the mark. On the other hand, mentors will question mentees’ dedication when missed coaching sessions become commonplace. With this next point, beware of the tripwire effect of mentoring mediocrity. Average shouldn’t be an option for you, or any mentor for that matter. Good. Better. Best. Those are your three options. Now, good mentors can leverage their motivational proficiencies as change-agent specialists. They may motivate well but often fall short in their inspirational skillsets. Better mentors are prolific in how they inspire others. They may connect well but typically fall short in their transformational competencies. Very few mentors reach the rarified status of influence greatness. Why? The best mentors motivate and inspire their mentees through a life of purpose and legacy of goodwill. These influencers are masterful strategists in helping others connect the “why” dots of purposeful living with the “what” and “how” circles of leadership excellence and legacy continuity.

A mentor’s inability to merge sociology, psychology, and anthropology is another reason why mentoring initiatives flatline. You don’t have to be a tenured professor or doctoral candidate, but you do need to be a well-rounded student in these areas if mentoring effectiveness is your goal. Human beings are unique. However, they tend to act in predictable ways based on their social class mindsets, habits, and beliefs. How people think has a great deal to do with how their brain is wired. Some people are analytical or methodical in their formulation of information. Without an orderly process, things don’t make a lot of sense to this group. Others are moved by feelings, those sensations, pulsations, and vibrations that shape their mood and mode (or the speed in which they navigate life). Still others are harmony driven; they get along to go along rather than go along to get along. In fact, this brain type tends to relate well with every brain group through interpersonal dynamics. And finally, this last category of individuals will remember a face more easily than a name. They tend to have colorful personalities and visionary dispositions. With anthropology, this is perhaps the most controversial among the three “ology” factors. Of course, generalizations can lead to stereotypes when dissecting people groups and the way they’re likely to think, act, or behave. By embracing cultural differences — racial or otherwise — we’re able to refine, refocus, or reframe our diversity lens. Don’t run from controversy; utilize it for your mentoring benefit.

A third reason why mentoring initiatives come up short is rather obvious: most people are not well-versed in the art and science of inquisitiveness. The art part is how to phrase a question based on subtext, with the science part dealing with the syntax or structure of what to ask by context. I often say that the answer can be found in the questions you dare to ask. The best mentors tend to ask the most thorough and thought-provoking questions of their mentees. “What” questions are primarily concerned with information. Irene, the affluent woman mentioned earlier, should have asked Sheila, “What are you hoping to receive from our mentoring relationship?” An open-ended question that’s straight to the point. Sheila’s response would have likely provided Irene with a few clues about her previous mentee’s intentions and expectations, and more importantly, a framework by which boundaries could (and should) be established at the onset. “How” questions focus on process or strategy. A mentee may ask a mentor, “How were you able to overcome a difficult life event?” “Why” questions address intent, reason, or purpose, which can create incredible discomfort in the gut of the person being asked, especially if the subject matter is sensitive. For example, my kids have asked me through the years, “Daddy, why did your father abandon you as a child?” You probably can sense my pain in trying to formulate a response; I’m not sure that I’ve ever given them a satisfactory answer. I saw that mystery man three times in childhood — none after the age of nine. An alcoholic, he died at the age of 40; he drank at least one 40 ounce of malt liquor beer every single day. My father cared more about that bottle than the emotions bottled up inside of me. “Why” questions can be challenging for the sender and receiver, but they are absolutely necessary. For some mentees, they must go back there, to that haunting place, in order to get free here, a liberating space.

In summary, well-intentioned doesn’t equal well-executed. To quote Stuart Scott, the iconic ESPN in-studio host who passed away from cancer on January 4, 2015, “See, what, had happen, was”… an influence airball with so much on the line. As the lead, mentors should state and press their mentees on what the expectations are for the mentoring engagement. Included here are the deliverables, or who will do what (the baseline) and by when (the timeline). Be sure to highlight what the guidelines and guardrails entail. Among other factors, these consist of the preferred communication channel(s) for both mentor and mentee to interact, such as face-to-face meetings, online encounters, text messages, phone calls, or email exchanges. The do’s and don’ts of mentorship decorum fall under the etiquette basket or protocol category. Be honest. Be inquisitive (without prying). Be considerate. Don’t procrastinate. Don’t overstep. Don’t assume. Customize the do’s and don’ts that work for you and your mentee. Be flexible where necessary to get or keep the relationship on solid footing. Don’t be afraid — as a mentor or mentee — to hold the other person accountable. But make sure it’s with grace. Know thyself and take the time to get to know your protégé. Lastly, which type of mentor are you aiming for as it relates to the good, better, or best influence target?

Questions to Consider:

Which aspect(s) of Irene’s and Sheila’s mentoring engagement stood out to you? Why?

Where do you fall on the spectrum as a good, better, or best mentor? What metrics have you used to substantiate or validate your mentoring impact?

What lessons have you learned as a mentor or mentee in regard to why a mentorship engagement failed or succeeded?

Interested in Learning More?

Click the button below to learn more about my mentoring initiative and other empowerment offerings to assist you or your organization.

Related Articles

The Influencer in You - 5 Part Series #2

The Influencer in You: Why Mentoring Works, How It Changes Lives, and Where It Transforms Legacies

Series #2: The Mindset

To Fix a Mentee or To Be Fixated With Mentoring: What’s the Difference?

In this second installment, it’s imperative to discuss the mindset or psychology behind (or in front of) effective mentoring before an individual can hit the mark personally, professionally, or philanthropically as an A-rated influencer. And far too many mentors and mentees rather fix (or be fixed) than become fixated. Remember my reference on continuous improvement in the first installment? Well, it comes down to three simple words: good. better, and best. The litmus test of influence is where you fall on the spectrum of mentoring effectiveness. Good mentors make a difference. They help mentees achieve success in a given area, bounce back from a setback, or sidestep a self-inflicted problem. However, they can be better, and what’s better needs to be the absolute best. Good mentors facilitate “win” only or solo results, where the mentee alone benefits. It’s often a one-way, transactional relationship. Simply put, good mentors invest their brand capital or sweat equity for mentee development purposes. Better mentors assist with “win-win” exchanges or two-way results, where the mentee and influencer both benefit transactionally and transitionally in terms of growth markers. Better attitudes. Better choices. Better outcomes. But the best mentors oversee “win-win-win” arrangements or trifecta results, where the mentor, mentee, and mentorship community benefit transactionally, transitionally, and transformationally. Here, mentors are replicated, mentees are dedicated, and the mentorship community is vindicated (because they see an influence need and fulfill it). Mentees eventually become mentors, and mentorship becomes an organizational investment or community initiative when mentoring needs are fulfilled by honor rather than duty.

I don’t want to offend your intelligence (or anyone’s for that matter), but it’s important to define what a mentor, mentee, and mentoring relationship is in simple terms. As highlighted in my book, Momentum Power Play, mentors provide guidance and support (as do sponsors). However, they typically expect little in return from their protégés. They are usually drawn in to the engagement through an inspiration, information, or innovation connection. The mentee or mentor may be inspired by one another; admirable qualities — honesty, work ethic, humility, perseverance, and compassion for others, to name just a few — serve as touch points. Mentees often glean knowledgeable insights and advice from their mentors, with personal or professional development being a primary focus. Mentees often gain a much-needed boost to kick-start a goal or to stick with it to the very end. Motivation from afar or within arms reach is what mentors provide. (Sponsors, who do expect a return on their hands-on investment from their protégés, often have a strategic agenda with clearly defined expectations and boundaries.)

Keep in mind that a mentoring goal, objective, or task is the pursuit, not the attribute. It’s who you become along the way — during the mentoring relationship journey — that defines what you actually achieve as a mentor and how you’re likely to influence a mentee under your stewardship care (which can be mutually beneficial). Mentorship is the prize, self-mentoring the ultimate reward. Prizes are given, while rewards are earned. You’ll learn more about three of my prized mentors in upcoming articles, but here’s a quick overview of the impact Donna James, Clark Kellogg, and Steven Davis have had on my life. Donna James is an impressive individual, holding board positions with several Fortune 500, publicly traded companies. She’s humble, diplomatic, and incredibly bright; traits that I’ve been able to refine, from her shining example, in my own life. James is managing director of Lardon & Associates, LLC., a consulting firm. Clark Kellogg is best known for his basketball analyst work with CBS Sports. He is articulate, witty, and courageous (given the fact that he has to share studio time with Mr. Lightening Rod, Charles Barkley, during the NCAA tournament). A former Buckeye basketball great and ex-NBA star, Kellogg has served as an invaluable mentor to me on marriage, ministry, and meaning, as in life’s purpose. Steven Davis, former CEO of Bob Evans, passed last year. Words such as distinguished, polished, and accomplished come to mind first. I’m showing my ghetto fab ways, but I’d often stop by his home unannounced to watch this astute man in action — how he treated his wife, influenced his daughters, and kept his cool when I asked him difficult questions (for example, “How does a black man navigate white corporate America without being viewed as a charity case?”)

Mentoring success is a journey, not a resting place or comfort space.

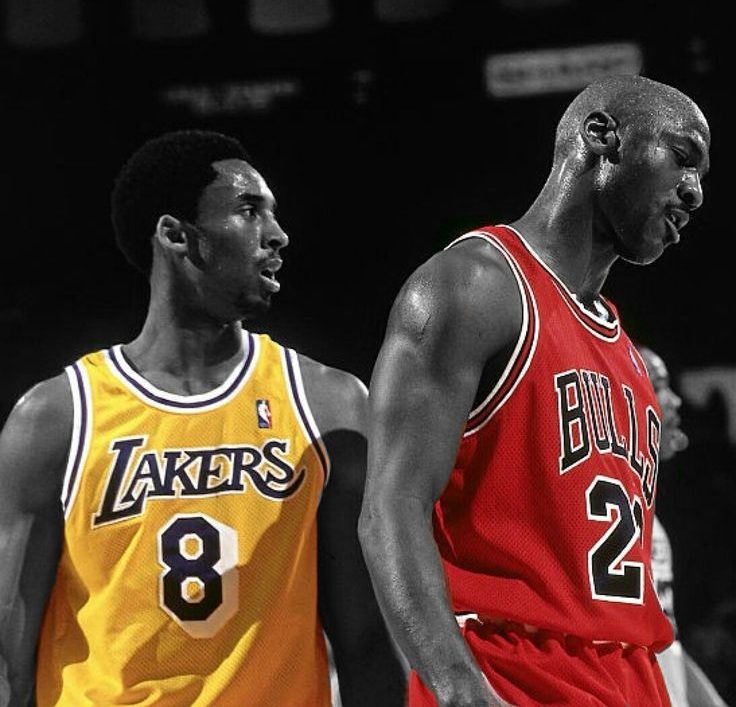

In closing, let’s end on a high note with a few pointers from two of the game’s greatest NBA players — Michael Jordan and Kobe Bryant. Now, their fixation on greatness rubbed so many people the wrong way. I witnessed it firsthand while playing for the Sacramento Kings in the 1990s and early 2000s. They irritated their teammates, aggravated sportswriters, and frustrated opposing fans, especially in hostile arenas on the road. These iconic figures were never satisfied with what they accomplished the previous season, past game, or last acrobatic shot. Why? Because comfort is the enemy of growth, especially when a self-mentoring investment or influence opportunity is on the line. And it has everything to do with excellence, not perfection. Jordan and Bryant displayed this every time they stepped on the court. Their secret, which can be yours, too? Greatness defined is process refined. Don’t settle for influence mediocrity. Aim for outlier status. Keep working on your internal and external improvement strategy, no matter the result. Be a growth-oriented difference-maker. Develop a mentoring mindset that won’t let you go through the motions. Ever. Mentorship is leadership, and please don’t forget this: You can’t take anyone further than where you currently stand. Doesn’t matter if it’s a mentee, sports team, or department.

Questions to Consider:

Which areas of your influence strategy do you need to refine as a mentor or sponsor? Be honest.

What are your most rewarding and challenging aspects of mentoring as a mentee, mentor, or mentorship organization? Why?

Who has had the biggest impact in your life, leadership, and legacy pursuits as a mentor from afar or within arms reach? Why?

Interested in Learning More?

Click the button below to learn more about my mentoring initiative and other empowerment offerings to assist your organization.

Related Articles

The Influencer in You - 5 Part Series #1

The Influencer in You: Why Mentoring Works, How It Changes Lives, and Where It Transforms Legacies

In celebration of National Mentoring Month, I am presenting a five-part series on why mentoring works, how it changes lives, and where it transforms legacies. Think about all of the mentors who’ve played an instrumental role in your life, leadership, and legacy pursuits. Have you thanked them lately? Caregivers, coaches, teachers, pastors, managers, social workers, and others have influenced us in profound ways. In turn, how do we “pay their investment forward” by making a mentoring difference inside and outside the workplace? Let’s set our game plan aside for a moment. Here’s what we do know. Mentors come in all shapes and sizes. Some are tall like me, while others are vertically challenged. They cover the racial spectrum; no ethnicity (or gender or social class) has a monopoly on who gets mentored. We’re all being influenced by someone or something, either positively or negatively. One thing is certain, however: seasoned mentors are bonafide tour guides. They transport their mentees to places and spaces by way of experience. The road frequently traveled is the path of familiarity. Of course, some newbie influencers, notably peer-to-peer mentors, won’t have an accurate lay of the land until they navigate it alongside their youthful counterparts. Yes, it’ll be fraught with pitfalls, roadblocks, and hazard signs. Please note: Growth can’t occur without some degree of topographical friction. Mentors must deal with their fair share of detours.

Without his fanfare, I’ve been called a softer version of David Goggins, a man with an impressive pedigree as a former navy seal and current world-class speaker. I’m quite familiar with who he is (because of the comparisons). But only recently — on January 3, 2024, while working out when I didn’t feel like it — did I become acquainted with his in-your-face style. Within minutes of the interview with Andrew Huberman on YouTube, Goggins discussed what makes him click, stick, and tick. He has little sympathy for others (his words, not mine!); I am quite empathetic. He admittedly has memory and recall struggles; learning comes quite naturally and easily to me. He grew up a chunky kid, weighing over 300 pounds in childhood; soaking wet, adding pounds to my 6’9” frame has always been incredibly difficult, even in adulthood. But the thing we do have in common is an insatiable appetite for self-mentoring. You see, most of us tend to wear the “self-motivated” label as a badge of honor. And there’s nothing wrong with this! But I prefer “self-mentored” since motivational cues can be fleeting when warm, fuzzy feelings stop flowing. Whether in a solo or crowded setting, self-mentoring proponents realize that their audience of one will always hold them accountable. As both a cheerleader and critic, the echo chamber of internal growth wouldn’t have it any other way.

The litmus test of effective mentoring is continuous improvement. I know, a trite saying that doesn’t carry as much weight as it once did (circa 1990s). Today, that expression is so passé. But change can’t take place on the outside unless transformation occurs on the inside. Never being content with the status quo is how anyone, and everyone, can become a top-notch mentor or change-agent specialist. No, you don’t have to reach a 10,000 hour milestone to obtain outlier status in the influence arena (as highlighted in Malcolm Gladwell’s bestselling book, Outliers). You can start right now — today. But most people talk themselves out of a mentoring commitment for several reasons:

- They are quick to point out, “I just don’t have the time.” Join the crowd; we’re all super busy. I realize my response sounds Gogginish 🙂

- An autopilot existence is perfectly fine for the vast majority of Americans. If no day is different than the next, then you, my friend, are tiptoeing the line of a mediocre life. Keep in mind that the currency of change requires an ongoing payment to sustain growth.

- A lot of mentoring fence-sitters don’t know where to start.

Well, look around. Our households, extended families, friendship circles, work places, and communities are screaming for mentors. Of the relatable, reliable, and reputable kind. Add reasonable to the mix, too. In this series, I’ll challenge you (just like David Goggins) to hit the influence mark personally, professionally, and philanthropically. Why? Because when you see a mentoring need and don’t fulfill it, a lot of innocent people get left behind due to your awareness breach — many of them permanently.

Questions to Consider:

Who has had the biggest mentoring influence on your life personally, professionally, and philanthropically? Why?

What hangups, holdups, and hiccups do you have with mentorship or sponsorship in an organizational setting? Be honest. (The difference between mentors and sponsors? Mentors make an investment, while sponsors expect a return on their investment. Their ROI is often based on a quid pro quo arrangement with protégés.)

How likely or unlikely are you to enter a mentoring engagement with someone who doesn’t look, think, or act like you (or your comfort zone clique)? Why?