MLK Installment #5

Classism in Corporate and Entrepreneurial America: The Economic Mobility Road Is Paved by Rocky Experiences

We have more of a class crisis in this country than a color conflict. MLK fought for financial justice just as much as he did for social recognition, political capital, or even racial harmony. Without equity or economic skin in the game, black and brown Americans will always feel like second-class citizens, no matter how we’re genuinely (or insincerely) accepted in this country. Equality is the historical payout for an injustice debt that has accrued with interest and deferred through countless IOU empty payments for hundreds of years, but equity pays off an outstanding bill owed to legacy benefactors by vested parties for generations to come. That includes you, me, us. If the government is limited in what it can do to create a more fair and just economy, without any guarantees of course, then who should pick up the slack? I nominate corporate America and entrepreneurs to step forward, the two formidable drivers of economic ingenuity.

In this final installment of the MLK Series on Race in America, you’ll be challenged on three fronts. First, you will be asked to step out of your comfort zone to better understand colleagues who are stuck, or perhaps stranded, inside their place of refuge. Second, you will be confronted with (or by?) information that may very well contradict generally accepted attitudes and beliefs about social classes, including your own. Third, you will be given a mandate to broach the subject of classism with others inside and outside the workplace to make an uncomfortable subject comfortably rewarding to scrutinize. If you’ve read my other articles, I’ve been consistent with this theme: intentional growth can only be achieved through experiential discomfort. Take a deep breath; we’re going up to a high place to meet others in their low space. (Yes, oxymorons are an integral part of my unorthodox writing style. After all, I am left-handed, which positions me in the 10 percent rare or “odd” category of all human beings.)

Why Class in Corporate America Is Such a Taboo Subject to Consider, Let Alone Discuss

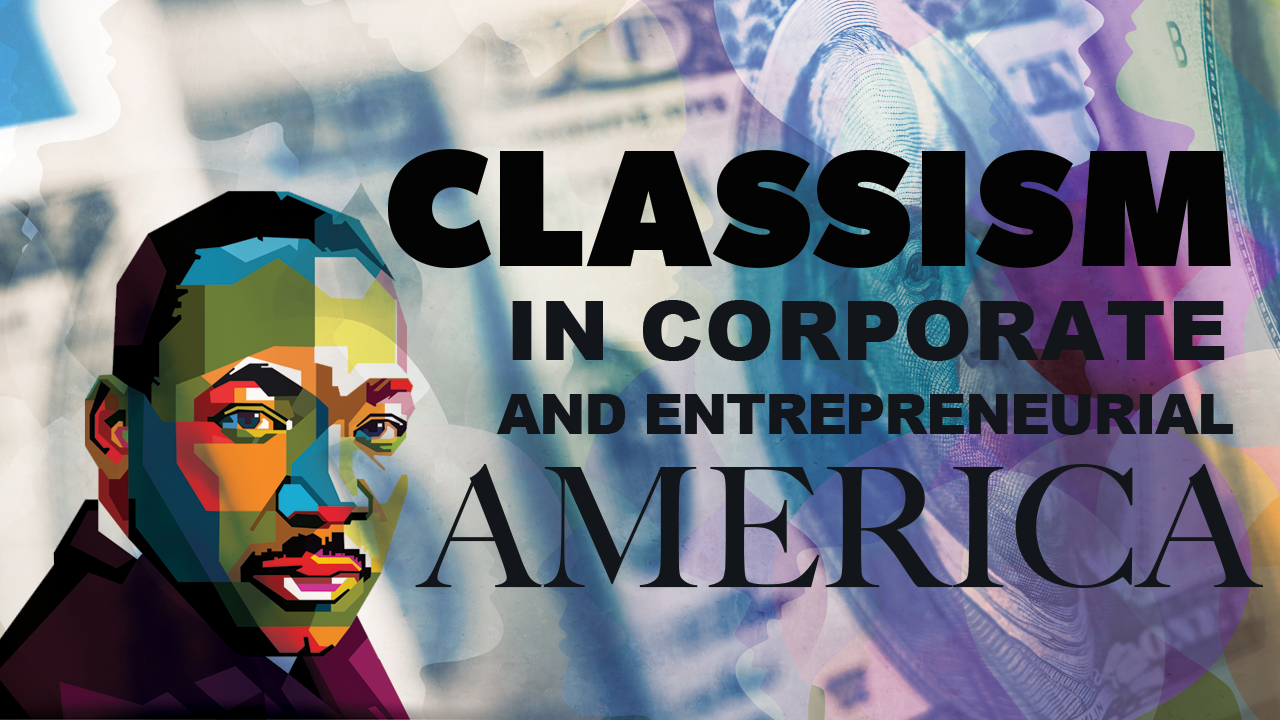

Behavioral finance explains the “what” in front of economic decisions, but psychographics uncovers the “why” behind their scaffolding frameworks. Here’s what I mean. How an individual, couple, or family spends, saves, invests, protects, or gives away money is largely shaped by their Sociopsychonomic filter. It’s both instinctive and intuitive, a foundational structure that serves as a default behavior pattern based on preconditioned mindsets around financial matters. And if a bad habit is hard to break, then an upgraded mindset is easy to keep. Let’s examine the word Sociopsychonomic, a term I coined that provides much-needed context to the classism controversy, and see where it shows up in corporate America.

The classism chasm in corporate America became more pronounced during the Covid pandemic, and quite frankly, hasn’t abated even as some semblance of normalcy returns. White-collar employees were (and many still are) able to work from the comforts of home, but brown-collar or base-level employees didn’t have this luxury, especially those in the hospitality, restaurant, and leisure sectors. In fact, many of them were let go. Those at the top of the economic food chain invested and profited greatly in a rock-bottom stock market, while their struggling peers took on more debt to stay afloat. Low-income wage earners who did keep their jobs were pressed to find alternative childcare arrangements when schools shut down, minimize stress in a stressfully chaotic living environment, and had to do significantly more work for less pay (what choice did they really have?) The poverty tax is glaringly obvious during times of local, national, or global turmoil. The next crisis — just around the corner — will be even more burdensome for them. Of course, the middle class (aka blue-collar workers) suffered considerably as well in making ends meet during Covid. They had to work two or three jobs, max out their credit cards when available credit was drying up, and/or borrow against their retirement accounts just as the stock market plummeted.

Why the subject of classism isn’t addressed inside the workplace might have a lot to do with the uncomfortable nature of social class dynamics in America. Favorable parking spaces, flexible schedules and accommodating work environments, and higher salaries (but with greater responsibilities) aren’t the only distance factors enjoyed by white-collar employees, also known as privileged lane runners. They are often viewed as the firm’s intellectual asset providers and value-driven creators by shareholders, board of directors, clients or customers, and even among their lower-salaried colleagues. This pecking order of importance isn’t a figment of imagination; many blue- and brown-collar workers express their concerns in feeling underrepresented in matters related to their overall contributions and self-assessment critiques. In-house surveys and DE&I programs rarely address the classism problem. In an interview, John H. shared with me, “This is exactly how I feel, and many other work peers who are in the same boat. As a blue-collar employee, I just don’t think my voice is being heard or valued. We have thousands of workers at this company, but only a few have the ear of top management.”

What many privileged lane runners fail to grasp is this: the employee flow charts or hierarchal structures in which they oversee has birthed and bred segregated groupings by virtue of shared (really, “felt”) oxytocin connections. White-collar employees typically associate and congregate with peers who tend to look, think, and/or act like them. The same can be said for blue-collar employees as well as brown-collar or base-level workers. Work environments are quite cliquish, this based largely on comfort rather than convenience. In other words, where colleagues feel they stand within an organization can mirror how they navigate occupationally and opportunistically, or even who they sit with in large (or small) group settings.

Whenever I’m invited to present, I usually walk around the room and greet a few employees prior to my speech, asking these three questions, with an inviting smile of course: Who do I have the pleasure of meeting? What is your role with this organization? How can I assist you today inside and outside the workplace? Obviously, correlation doesn’t equal causation but it should lead to contemplation. Here’s what I’ve observed. A predictable pattern often emerges as random seating is occupied by familiar faces, lane groupings, and employment positions. Even when arriving early, many brown-collar employees tend to sit on the periphery or in the back, blue-collar employees in the middle, and white-collar employees (or those with C-Suite aspirations) toward the front. Where they sit is known, but the “why” is not. I can’t share all of my secrets for “free,” but a deep dive into neuroscience and biochemistry will provide many cues and clues.

How Do Lane Groupings Cope with an Uncertain Financial Future Inside and Outside of Corporate America?

Take a look at the condensed chart below from our Lane Change U holistic development website. What piques your curiosity about a particular lane grouping? Which group(s) do you identify with personally, professionally, and/or philanthropically? Where am I missing or hitting the mark in my assessment of lane groups? How can this information help you relate better with your colleagues, customers/clients, or community partners? Why do you think classism is so difficult to discuss inside or outside of corporate America?

With a global geographic template, Lanes 4 and 5 are best equipped to deal with the unpredictable state of world affairs. Contingency planning or strategic forecasting is their domain, where the impact of international events or catastrophic crises seldom catch them off guard. They are proactive planners, lanes 3 and 6 reactive planners, and 1 and 8 bioactive planners. Proactive planners have a system in place to handle unforeseen events, a team of professionals who can assist them in making the right moves from a holistic vantage point. This doesn’t eliminate unforeseen problems, but can invariably diminish the effects of mental and emotional stressors in dealing with circumstances beyond their control. Reactive planners, lanes 3 and 6, respond to unexpected events or setbacks using their own devices but on others’ terms. In other words, their tightrope journey is often missing a corresponding balancing bar (which lanes 4 and 5 do have) to navigate an ever-changing, global landscape. The safety nets leveraged by lanes 3 and 6? You guessed it, unions, political parties, and their commendable work ethic. Bioactive planners have to feel a certain way before they take (or fake) a definitive course of action. Thus, they are more prone to displaying false-start tendencies in their life race while passing along the baton of emotion-guided behavior patterns to their legacy followers. World affairs disproportionately punish lanes 1 and 8 more than the other lane groupings; they’re often indifferent or oblivious to what happens around the globe. No matter the lane grouping, effective planning provides options and opportunities to capitalize on — instead of being punished by — the unpredictable state of world affairs.

I won’t explain in great detail the “why” but will express the “what” in regard to three class-related phenomena inside corporate America. Workers from the underdog lanes, especially black and brown employees, contribute significantly less to their 401(k) plans than other lane groups. A company or employer-sponsored match is technically “free money,” so why are they so reluctant to participate? Might it have a lot to do with their limited incomes? Perhaps. Could the primary reason be that investing, given the odds at play, is considered a close cousin of gambling by this demographic? Maybe. How about the unfamiliarity with wealth-building principles that are foreign to their way of thinking? Possibly. One thing is certain: They believe a bird in a hand is better than two in a bush.

For comfort zone lanes, the middle class, why do they treat W-4 withholdings as a forced savings vehicle? Providing Uncle Sam with an interest-free loan, returned in the form of a tax refund, offers peace of mind to middle-income earners. Since many of them take the standard deduction instead of the itemized deduction on their tax return, they could reduce their W-4 withholdings throughout the year (at the start of a given year) and use these “extra funds” to invest in the stock market, start a side business, contribute to a child’s 529 college account, reduce interest-bearing debt obligations, or apply them toward a real estate investment fund (which happens to be a comfortable place for the middle class to invest given the tangible nature of land or property). Like most things in life, this lane grouping’s primary concern is quite clear: they only want to deal with what’s in front of them. Right now is here; the future is not. Their focus is most content in the present moment.

Lastly, inside lanes of privilege do tend to suffer (among others) from one noticeably glaring drawback. They are often quick to conclude that a simple formula is the key to closing the wealth gaps in America. Do A + B + C to get D. Voila! Unfortunately, classism and the differences among lane groupings, as well as the subsets within them, are quite nuanced. Employees from traumatic backgrounds usually have compromised circadian rhythms, which regulate, like a symphony conductor, nearly ever system in the body. If a life is out of rhythm, then so will one’s finances, economic compass, and monetary filter. By all means, blue-collar employees can stay true to their down-to-earth roots. However, they do need a white-collar, wealth-building mentality as promises owed by employers turn into obligations not kept to employees. Gone are the days of guaranteed pensions, lifelong job security, and free health insurance (nothing is ever free!) When you’re at the top of the employment hierarchy, it’s easy to assess things from a 30,000 foot view. But the ground floor is where you/me/us can come in contact with common folk who are scared to death of what the future holds financially. Let’s help each other without pointing fingers in (but certainly at) the process.

A Chalkboard Scratching Moment That Still Gets Under My Skin

I’m showing my age (might you be as well?), but I remember those ear-piercing moments when teachers, back then, female in the majority of cases, would rattle my inner core. How so? Their nails would, out of nowhere, scratch the chalkboard while writing incursive. Several of my classmates, including me, would immediately cover our ears as the penetrating sound sent the alarm bells ringing deep inside our gut. We were caught off guard and did our best to mitigate the effects of that screeching, attention-deflating noise. Ironically, our sense of wellness is largely produced in the gastrointestinal (GI) tract through the serotonin pathways. Over 90 percent of the production of this feel-good neurotransmitter is manufactured naturally in the GI tract, with favorable or unfavorable sounds, words, and foods boosting or busting our feel-good meter. And every time someone uses the term “financial literacy,” especially in the world of banking or financial services, I am reminded of those sickening, chalkboard-scratching moments in elementary school.

A few years ago, I had a meeting with a banking CEO. We discussed a win-win-win partnership to close the wealth gap societally and organizationally; his bank, our nonprofit, and the community footprint in which his institution served would all benefit. The following account with the banking CEO crystallizes my thought process on financial literacy. (Yes, it hurts to even write the term, let alone revisit a conversation about it.)

Me: What are your thoughts on where we stand in closing wealth disparities here in Central and Appalachia Ohio?

Banking CEO: Well, the first step we need to take is to improve the financial literacy of disadvantaged communities. Without this knowledge, they will always be playing catch up. Right?

Me: Well, with all due respect sir, I have to challenge your conventional framework in a critical area.

Banking CEO: (leaning back while creating distance between us) Really, in what way?

Me: (showing noticeable agitation) You see, the term ‘financial literacy’ is fraught with all kinds of negative connotations. To state matter of factly that someone, or, in this case, a community, needs literacy is to imply that they are or could be viewed as being illiterate.

Banking CEO: Wow, this perspective never crossed my mind.

Me: As someone who grew up fatherless on welfare in a low-expectation environment, I take tremendous offense to this term. Capability is one issue, but accessibility is something altogether different.

Banking CEO: What do you mean?

Me: Vulnerable communities are capable of learning anything, so long as the messenger communicates a relatable, palatable, and identifiable message in an easy-to-understand language. When this occurs, foreign concepts come alive; the veil of secrecy has been lifted from their eyes. More importantly, these individuals feel empowered. In fact, they’re now granted access or entrance into a new world of upgraded words. This is how we can partner to change lives and legacies one family or inner-city community at a time.

Banking CEO: (breathing a sigh of relief) Makes perfect sense to me, and from this day forward I will never use the term ‘financial literacy’ again. Mark my word.

Me: Thank you.

Take your pick. Financial education. Financial wellness. Financial empowerment. Financial success. Financial fitness. Financial freedom. Financial stewardship. Economic mobility. Economic wellbeing. Economic health. Economic harmony. Economic viability. Fiscal diligence. Fiscal resilience. Fiscal sustenance. Wealth security. Wealth parity. Wealth privilege. Knowledge currency. Please use any of these terms interchangeably when advocating on behalf of underserved populations or disenfranchised groups, but not financial literacy. Literacy, as highlighted, connotes a lack of knowledge about a given subject, being unskilled in a particular area, or worse, someone who is incapable of learning due to underlying deficits, deficiencies, or defects. See how problematic financial literacy is? Semantics matter a great deal when ________ ________ (you choose) is on the line personally, professionally, or philanthropically. I cover the phenomenon of classism in great detail in my book, Sociopsychonomics: How Social Classes Think, Act, and Behave Financially in the Twenty-First Century.

In closing, economic mobility is arguably the most important skillset a young (or even seasoned) employee must develop in corporate or entrepreneurial America to survive, let alone thrive in an ever-changing and dynamic landscape. Its pillars include the ability or conviction to live out one’s values, the agility or condition to labor in one’s value proposition, and the affinity or connection to lead with one’s invaluableness. Those who do all three equally well will be coveted in boom or bust labor market cycles. These outlier attributes are not native to a particular ethnicity, class, or gender, but they can certainly help any employee run a life race or complete a legacy journey with grace, the love kicker. When you add value consistently and efficiently — regardless of the task or activity — people take notice. Economic mobility is a rocky road in corporate America. The terrain can be remarkably treacherous; its pathways quite taxing and exhilarating, and beneficial outcomes anything but a sure bet. In due season however, the work involved will eventually be rewarded. The Law of Compound Interest wouldn’t have it any other way.

Related Articles

Contact

Connect with us.

If you would like to participate in the Post-Assessment Survey of the MLK Series on Race in America, please send an email. I look forward to speaking with you.